A Guide to Sailboat Insurance

Imagine sailing freely on the open seas, wind in your hair and a sense of adventure in your heart. But amidst the exhilaration, don’t forget the importance of protecting your sailboat.

In this guide, we’ll show you how to navigate the world of sailboat insurance, helping you choose the right coverage, avoid common mistakes, and lower your premiums.

So set sail with confidence, knowing that your prized vessel is safeguarded against any unforeseen circumstances.

Table of Contents

Understanding Sailboat Insurance Coverage

You should consider reviewing your sailboat insurance coverage to ensure you’re adequately protected. As someone who values freedom and adventure, it’s important to understand the ins and outs of your insurance policy.

Finding affordable sailboat insurance can be a challenge, but with a few tips and tricks, you can secure the coverage you need without breaking the bank.

When searching for affordable sailboat insurance, start by comparing quotes from different providers. Look for companies that specialize in marine insurance as they may offer better rates and tailored coverage options. Additionally, consider bundling your sailboat insurance with other policies like auto or home insurance to potentially save money.

Understanding liability limits is crucial when it comes to sailboat insurance. Liability coverage protects you in case of accidents or injuries caused by your sailboat. It’s important to assess your risk exposure and choose liability limits that adequately protect your assets. While higher limits may come with a higher premium, they offer greater financial security.

Don’t forget to review the terms and conditions of your sailboat insurance policy. Look for any exclusions or limitations that may affect your coverage. It’s also a good idea to regularly reassess your insurance needs as your sailboat usage and value may change over time.

Types of Sailboat Insurance Policies

When considering sailboat insurance policies, it’s important to thoroughly compare and understand the different types available. Sailboat insurance provides essential protection for your vessel and yourself while out on the open water.

Here are some key types of sailboat insurance policies to consider:

Liability Limits: This type of insurance policy covers any damages or injuries caused to others while operating your sailboat. It’s important to carefully review the liability limits of each policy to ensure you have adequate coverage in the event of an accident.

Coverage Exclusions: It’s crucial to carefully review the coverage exclusions of each policy to understand what isn’t covered. Some common exclusions may include wear and tear, damage caused by improper maintenance, and acts of war or terrorism. Make sure you’re aware of these exclusions to avoid any surprises down the line.

Additional Coverage Options: Many sailboat insurance policies offer additional coverage options that you can choose from based on your specific needs. These options may include coverage for personal belongings on board, emergency towing services, and even coverage for racing events.

Factors to Consider When Choosing Sailboat Insurance

Considering the sailing conditions and intended use of your sailboat is crucial when choosing insurance coverage. There are several factors to consider when selecting sailboat insurance that will best suit your needs.

First, you need to take into account the sailing conditions you typically encounter. Are you sailing in calm waters or do you venture into rough seas? The type of coverage you choose should align with the risks associated with your sailing environment.

Second, think about the intended use of your sailboat. Do you use it for leisurely weekend trips, or do you participate in competitive racing? Different insurance policies offer varying levels of coverage for different uses.

To make it easier for you, here is a table summarizing the factors to consider when choosing sailboat insurance:

Navigating Liability Coverage for Sailboat Owners

There are several key factors to understand and navigate when it comes to liability coverage for sailboat owners, such as the amount of coverage needed and the potential risks involved. It’s important to have a clear understanding of liability limits and how they can protect you in the event of an accident.

Here are some points to consider:

Liability Limits : Determine the appropriate liability limit for your sailboat insurance policy. Higher limits provide more coverage in case of accidents or damages caused by your sailboat. It’s crucial to assess your personal risk tolerance and the potential costs associated with liability claims.

Coverage Exclusions : Familiarize yourself with the coverage exclusions in your policy. These are specific situations or events that may not be covered by your insurance. Understanding the exclusions can help you make informed decisions and potentially avoid costly surprises in the future.

Special Considerations : Take into account any special considerations related to your sailboat. For example, if you plan to charter your boat or participate in races, you may need additional coverage. Discuss these factors with your insurance provider to ensure you have the appropriate coverage for your specific needs.

Protecting Your Sailboat Against Physical Damage

To protect your sailboat against physical damage, it’s important to have insurance coverage that includes accidents and the cost of repairs.

Accidents can happen unexpectedly, whether it’s a collision with another boat or damage caused by severe weather conditions.

Coverage for Accidents

You should definitely check if your sailboat insurance policy includes coverage for accidents caused by collisions with other vessels. Accidents can happen, and the cost of repairs can add up quickly. It’s important to have the proper coverage in place to protect yourself and your investment.

Here are a few common accidents that could occur while sailing:

Collisions with other vessels: Accidents happen, and if your sailboat collides with another boat, it can result in significant damage. Make sure your insurance policy covers this type of accident.

Groundings: Running aground is a common occurrence for sailors, especially in shallow waters. If your sailboat gets stuck on a sandbar or hits a submerged object, it can cause damage to the hull and other parts of the boat.

Storm damage: Severe weather conditions can cause significant damage to your sailboat. High winds, heavy rain, and rough seas can lead to costly repairs.

Having the right insurance coverage can give you peace of mind and protect you from unexpected expenses. Take the time to review your policy and make sure you have the coverage you need.

Cost of Repair?

If your sailboat sustains physical damage, it is important to consider the cost of repair in order to make an informed decision about your insurance coverage. Understanding the cost of repairs will help you evaluate whether it is worth filing an insurance claim or paying out of pocket. To assist you in this process, here is a breakdown of the typical cost of repairs for common sailboat damages:

Specialized Coverage for Racing Sailboats

When it comes to racing sailboats, specialized coverage is essential.

Unlike regular sailboats, racing sailboats have unique policy considerations that need to be taken into account.

From coverage for regattas and races to higher premiums and deductibles, it’s important to understand the specific insurance needs of racing sailboats.

Racing Sailboat Coverage

Make sure your racing sailboat coverage includes specialized coverage for racing events. Racing sailboats require specific insurance coverage to protect against the unique risks involved in competitive sailboat events. Here are three important considerations to keep in mind when selecting your coverage:

Hull Insurance : This coverage will protect your sailboat from damage caused by accidents, such as collisions or grounding during a race.

Liability Insurance : In the fast-paced world of racing sailboats, accidents can happen. Liability insurance will cover any damages or injuries caused to others during a race.

Equipment Insurance : Racing sailboats often have specialized equipment that can be expensive to replace. Ensure your policy covers the cost of repairing or replacing your racing gear, such as sails, rigging, and instruments.

Unique Policy Considerations

There are three important policy considerations to keep in mind when selecting coverage for your racing sailboat.

First, make sure to thoroughly review the policy exclusions. These are the situations or events that your insurance company won’t cover. It’s important to understand these exclusions so that you can plan and prepare accordingly.

Second, pay close attention to the coverage limits. These limits determine the maximum amount that your insurance company will pay in the event of a claim. It’s crucial to assess these limits to ensure that they align with the potential risks and costs associated with racing sailboats.

Premiums and Deductibles

You should carefully consider the premiums and deductibles associated with specialized coverage for your racing sailboat. Sailboat insurance can provide peace of mind and financial protection in case of accidents or damage. To make the most informed decision, here are some key points to consider:

Premium discounts: Look for insurers that offer premium discounts for safety measures such as having a boating safety course, installing safety equipment, or having a clean claims history. These discounts can help reduce your overall insurance costs.

Choosing deductibles: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums, but it’s essential to ensure that you can comfortably cover the deductible amount in case of a claim.

Specialized coverage: Racing sailboats often require specialized coverage due to their unique risks. Make sure to evaluate the coverage options available for racing sailboats and choose a policy that adequately protects your investment.

Exploring Additional Coverage Options for Sailboat Insurance

Can you explain the benefits of adding additional coverage options to your sailboat insurance policy?

As a freedom-seeking sailor, you understand the importance of protecting your beloved sailboat from any unforeseen events. Exploring coverage limits and understanding policy exclusions are crucial steps in ensuring comprehensive protection.

By adding additional coverage options to your sailboat insurance policy, you gain peace of mind and the freedom to navigate the open waters without worry.

One of the main benefits of adding extra coverage is the ability to customize your policy to meet your specific needs. You can choose to enhance your coverage for damages caused by natural disasters, such as hurricanes or storms. This ensures that even in the face of nature’s fury, you’ll be financially protected.

Another important coverage option to consider is liability insurance. This protects you in the event that you cause damage to another person’s property or injure someone while operating your sailboat. By having this additional coverage, you can sail with confidence, knowing that you have the means to handle any potential liability claims.

Furthermore, adding coverage for personal belongings onboard your sailboat is essential. This protects your valuable possessions, such as electronics, navigation equipment, and personal belongings, from theft, loss, or damage.

Tips for Lowering Sailboat Insurance Premiums

If you maintain a good sailing record and take a boating safety course, you may qualify for lower sailboat insurance premiums. Here are some tips for reducing sailboat insurance costs and strategies for lowering sailboat insurance premiums:

Shop Around : Don’t settle for the first insurance provider you come across. Take the time to compare different policies and prices to find the best deal for you. Consider factors such as coverage limits, deductibles, and additional benefits.

Increase Deductibles : By opting for a higher deductible, you can lower your insurance premiums. Just make sure you have enough savings to cover the deductible in case of an accident.

Bundle Your Policies : Many insurance companies offer discounts when you bundle your sailboat insurance with other policies such as auto or home insurance. This can lead to significant savings on your premiums.

By following these tips and strategies, you can lower your sailboat insurance premiums and enjoy the freedom of sailing without breaking the bank.

The Claims Process for Sailboat Insurance

To expedite the claims process for sailboat insurance, make sure to promptly report any damages or accidents to your insurance provider. Time is of the essence when it comes to filing a claim, so don’t delay in notifying them about any incidents that occur. By doing so, you’ll help ensure that the claims process runs smoothly and efficiently.

When it comes to the claims process, it’s important to understand the timeline involved. Insurance companies typically have specific timeframes within which you’re required to report and file a claim. Familiarize yourself with these deadlines to avoid any potential complications or delays in receiving your settlement.

In addition to reporting the incident promptly, it’s crucial to gather all necessary documentation to support your claim. This may include photographs of the damage, estimates for repairs, and any relevant police or incident reports. By providing thorough documentation, you can help expedite the claims process and increase the likelihood of a favorable outcome.

Common Mistakes to Avoid When Insuring Your Sailboat

You should always carefully review your sailboat insurance policy to avoid common mistakes that could leave you underinsured in the event of an accident. Sailboat insurance is essential to protect your investment and ensure your peace of mind while out on the open water.

Here are some common mistakes to avoid:

Not understanding liability requirements : It’s crucial to familiarize yourself with the liability requirements set by your state or marina. Failure to comply with these requirements could result in legal consequences and financial burden in case of an accident.

Ignoring coverage limits : Many sailors make the mistake of overlooking the coverage limits in their policy. It’s important to know the maximum amount your insurance company will pay in the event of a claim. If your coverage limit is too low, you may end up having to pay out-of-pocket for damages or injuries.

Neglecting to update your policy : As your sailboat ages or you make modifications, it’s essential to update your insurance policy accordingly. Failing to do so may result in inadequate coverage or even denial of a claim.

By reviewing your sailboat insurance policy, understanding liability requirements, paying attention to coverage limits, and keeping your policy up to date, you can ensure that you have the right coverage in place to protect yourself, your sailboat, and your freedom on the water.

Stay safe and enjoy your adventures worry-free!

Expert Advice on Choosing the Best Sailboat Insurance Policy

When comparing sailboat insurance policies, it’s important to consult with experts who can provide guidance on finding the best coverage for your specific needs. Understanding liability and having adequate coverage for accidents are crucial aspects of sailboat insurance. You want the freedom to explore the open waters without worrying about financial burdens in case of an unfortunate incident.

To begin, liability coverage is essential because accidents can happen, even to the most experienced sailors. Imagine a scenario where your sailboat collides with another vessel, causing damage to both boats and possibly injuring individuals. Without proper liability coverage, you could be held personally responsible for the expenses, which could be financially devastating. So, make sure your policy covers liability for bodily injury and property damage.

Additionally, coverage for accidents is vital. Sailboats are susceptible to various risks, including storms, collisions, and even theft. Accidents can result in significant damage to your boat, leaving you with hefty repair or replacement costs. Having comprehensive coverage that includes accidents will ensure that you’re protected financially if the unexpected occurs.

To find the best sailboat insurance policy, consult with experts who specialize in this field. They can evaluate your needs, explain the various coverage options, and help you find a policy that provides the right protection for your sailboat adventures. Remember, the freedom to sail without worry comes from having the right insurance coverage.

Frequently Asked Questions

Can i insure my sailboat if it is older or in need of repairs.

Yes, you can insure your older sailboat or one that needs repairs. Sailboat insurance providers understand that boats age and require maintenance. They offer coverage options to protect your investment and give you peace of mind.

What Is the Difference Between Agreed Value and Actual Cash Value in Sailboat Insurance?

When it comes to sailboat insurance, understanding the difference between agreed value and actual cash value is crucial. Agreed value ensures you’ll be compensated for the agreed upon value, while actual cash value takes depreciation into account.

Are There Any Discounts Available for Sailboat Insurance if I Have Completed a Boating Safety Course?

Yes, completing a boating safety course can make you eligible for discounts on sailboat insurance. Not only will you save money, but you’ll also gain valuable knowledge that will benefit you on the water.

Does Sailboat Insurance Cover Me if I Sail in International Waters?

Does sailboat insurance cover you when sailing in international waters? You’ll be glad to know that many policies do offer coverage for international sailing, giving you the freedom to explore the open seas worry-free.

Can I Add Coverage for Personal Belongings and Equipment Stored on My Sailboat?

Yes, you can add coverage for your personal belongings and equipment stored on your sailboat. Sailboat insurance offers coverage options for personal belongings and equipment protection, giving you peace of mind while enjoying your freedom on the water.

Scott is a devoted boat enthusiast and provides invaluable insights, tips, and advice on boat insurance coverage, industry trends, and maintenance. Marine Insurance Now is the go-to resource for seasoned boat owners seeking insurance guidance and aspiring sailors embarking on nautical adventures. Scott's expertise and infectious passion make his blog a must-read for boat enthusiasts and is making waves in the boating community.

View all posts

Related Posts

All About Uninsured/Underinsured Watercraft Coverage

The Ins and Outs of Bass Boat Insurance

The Essentials of Salvage and Wreck Removal Insurance

Affiliate Disclosure - Terms and Conditions - Privacy Policy

Sailboat Insurance: Understanding Coverage and Cost

Sailing is a wonderful hobby that provides endless opportunities for adventure, exploration, and relaxation. Whether you’re a seasoned sailor or just starting out, protecting your investment with a comprehensive insurance policy is essential. Sailboat insurance provides coverage for damages to your boat and personal injury, and helps you stay financially protected in the event of an accident.

In this blog post, we’ll explore the different types of sailboat insurance, coverage options, and factors that impact the cost of insurance for your sailboat.

Table of Contents

Types of Sailboat Insurance

There are several different types of insurance policies available for sailboats. Some of the most common include:

- Hull Insurance : This type of insurance provides coverage for physical damage to your sailboat’s hull. This may include damages from storms, collisions, theft, or other incidents.

- Liability Insurance : Liability insurance covers you for damages you cause to others, such as injury to another boater or damage to another boat.

- Medical Payments Insurance : This coverage pays for medical expenses incurred by you or your passengers in the event of an accident on your sailboat.

- Uninsured Boater Coverage : If you are involved in an accident with an uninsured boater, this coverage will pay for your damages and medical expenses.

- Personal Effects Coverage : This coverage pays for damages or loss of personal items, such as clothing, electronics, or fishing gear, while on your sailboat.

Coverage Options

When choosing a sailboat insurance policy, it’s important to consider the coverage options that are available. Some of the key options include:

- Coverage Limits : The coverage limit is the maximum amount your insurance company will pay for a covered claim. You’ll need to determine what coverage limits are appropriate for your sailboat, taking into account its value and your potential exposure to risk.

- Deductibles : A deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible can lower your insurance premiums, but you’ll need to weigh the trade-off between lower costs and increased financial risk.

- Watercraft Towing and Assistance : This coverage provides for towing and assistance in the event of a mechanical breakdown or other emergency.

- Navigation Limits : Some insurance policies limit where you can sail your boat, typically to coastal waters within a specified distance from shore. Make sure to understand the navigation limits of your policy and whether they are adequate for your sailing plans.

Factors That Impact Insurance Costs

There are several factors that can impact the cost of your sailboat insurance, including:

- The Age, Type, and Value of Your Boat : Newer, larger, and more expensive boats typically cost more to insure than older, smaller, and less valuable boats.

- The Location and Type of Use : Where and how you use your sailboat can also impact your insurance costs. For example, sailing in areas with high wind speeds, or participating in racing, may result in higher insurance premiums.

- Your Sailing Experience : Your sailing experience and training can impact your insurance costs, as insurance companies consider you to be a higher risk if you have limited experience or training.

- Claims History: Your claims history can also impact your insurance costs, as insurance companies consider you to be a higher risk if you have a history of filing claims.

In conclusion, sailboat insurance is a necessary investment to protect you and your investment. By understanding the different types of coverage, coverage options, and factors that impact insurance costs, you’ll be well equipped to choose the right policy for your sailboat. If you’re in the market for sailboat insurance, more it’s important to shop around and compare quotes from several insurance companies to find the best coverage at the best price. You can also work with a knowledgeable insurance agent to help you navigate the process and find the right policy for your needs.

When comparing quotes, make sure you understand what each policy covers, what your coverage limits are, and what your deductibles will be. It’s also important to review your coverage regularly and make any necessary changes as your sailboat and your sailing needs change over time.

Do I Need Insurance for my Sailboat?

As a sailboat owner, it’s important to consider the potential risks and liabilities that come with owning a vessel. While it’s not legally required in all states or countries, having insurance for your sailboat can offer peace of mind and financial protection in case of accidents or damages.

Here are some key factors to consider when deciding if you need insurance for your sailboat:

- Liability : If you accidentally cause damage to another person’s property or injure someone while sailing, you could be held financially responsible for their medical bills or property repairs. Liability insurance can help cover these costs.

- Property Damage : Your sailboat is a valuable asset that you likely want to protect. Property damage insurance can cover repairs or replacements in case of damage from weather, collisions, theft, or other incidents.

- Legal Requirements : Depending on where you live or sail, you may be required by law to have insurance for your sailboat. Make sure to research the laws and regulations in your area to determine if insurance is mandatory.

- Marina or Dock Requirements: If you plan on docking or storing your sailboat at a marina, they may require proof of insurance before allowing you to use their facilities.

- Personal Finances: Can you afford to pay for repairs or damages out of pocket? Insurance can provide financial protection and prevent unexpected expenses from draining your savings.

In summary, while insurance for your sailboat may not be legally required in all cases, it’s important to weigh the potential risks and liabilities and determine if the financial protection and peace of mind are worth the investment. Be sure to research and compare different insurance options to find the coverage that best fits your needs and budget.

How to choose a good insurance for your sailboat

Choosing the right insurance for your sailboat can be a challenging task, but taking the time to carefully evaluate your options and consider your needs will ensure that you get the best coverage for your investment. Here are some steps to help you choose a good insurance policy for your sailboat:

Determine Your Coverage Needs

Before you start shopping for insurance, take some time to evaluate what you need coverage for. Consider the value of your boat, your sailing habits and locations, and any other factors that may impact your risk.

Shop Around

Get quotes from several insurance companies to compare coverage options and prices. Make sure to compare policies that offer similar coverage, and don’t be afraid to ask questions to understand what each policy covers.

Check the Financial Stability of the Insurance Company

Before choosing an insurance company, it’s important to check their financial stability and reputation. Make sure the company has a good rating from agencies such as A.M. Best, and check for any negative reviews or complaints.

Consider the Deductible

The deductible is the amount you’ll pay out of pocket before your insurance coverage kicks in. A higher deductible will lower your insurance premiums, but you’ll need to weigh the trade-off between lower costs and increased financial risk.

Read the Policy Carefully

Once you’ve chosen a policy, make sure to carefully read and understand the terms and conditions. This will ensure that you’re fully aware of what is and is not covered, and what your coverage limits are.

Work with a Trusted Insurance Agent

An insurance agent who specializes in boat insurance can help you understand your options and find the best policy for your needs. They can also answer any questions you may have and provide valuable guidance throughout the process.

Conclusion on How to choose a good insurance for your sailboat

In conclusion, choosing a good insurance policy for your sailboat requires careful consideration of your needs and a thorough evaluation of your options. By taking the time to shop around, compare quotes, and understand your coverage, you’ll be well equipped to choose a policy that provides the protection you need.

Overall, investing in sailboat insurance provides peace of mind and protection against unexpected events, so you can focus on enjoying your time on the water. Whether you’re a seasoned sailor or just starting out, take the time to consider your insurance options and choose the coverage that’s right for you.

We hope this post has helped you understand the ins and outs of sailboat insurance. Stay safe and happy sailing!

Emily Smith

Emily Smith is a passionate sailor and travel enthusiast, who has spent the last 8 years exploring the world by boat. From the tranquil waters of the Great Lakes to the roughest oceans, Emily has sailed it all and decided to share the knowledge on Sailingbetter.com blog. With a keen eye for detail and a talent for storytelling, Emily offers readers an insight into the thrilling world of sailing and the beautiful destinations it can take you to. When she's not out on the water, Emily calls Chicago, Illinois home and enjoys sharing her love for sailing with others. Join her on her journey as she continues to discover new horizons and inspire others to live life to the fullest.

Recent Posts

Lagoon vs Leopard Catamaran: Which Sailboat Is Right for You?

Introduction When it comes to cruising on the open waters, catamarans have gained immense popularity for their stability, space, and comfort. Two of the leading catamaran manufacturers, Lagoon and...

How to Determine Sailboat Weight: A Comprehensive Guide

Introduction Sailing is a thrilling and adventurous activity that has captivated humans for centuries. Whether you are a seasoned sailor or a novice looking to set sail for the first time,...

- BOAT OF THE YEAR

- Newsletters

- Sailboat Reviews

- Boating Safety

- Sailing Totem

- Charter Resources

- Destinations

- Galley Recipes

- Living Aboard

- Sails and Rigging

- Maintenance

- Best Marine Electronics & Technology

How to Navigate Marine Insurance in 2021

- By Jennifer Brett

- Updated: June 30, 2021

If you’ve been on the hunt for a marine insurance policy over the past year or so, you likely already know that it’s a challenging market. Sailing and cruising groups on social media and web forums are filled with frequent posts about people struggling to find coverage, keep coverage, or just afford it. It’s a problem that seems to be affecting beginning cruisers and circumnavigators, with old boats or new. So what gives? How did the situation get to this point, and what can sailors do to protect their dream?

“I’ve been doing this for 30 years, and I’ve never seen a market this hard,” said Morgan Wells, a yacht-insurance specialist with Jack Martin and Associates. “There’s been a great reduction in the number of insurance companies writing boat and yacht insurance, and the international-cruiser segment of the market has been more adversely affected, particularly for boats anywhere on the US East Coast, and even more so for people looking for new policies for Florida, the Bahamas and the Caribbean.”

Indeed, cruisers across the spectrum of locations and sea time are feeling the pinch. When looking to renew their current insurance policy last year, circumnavigators Behan and Jamie Gifford, who live aboard their 1982 Stevens 47, were met with a surprise. “When it came time to renew, we were quoted more than double our cost for insurance the year we planned to cross the Indian Ocean, 2015—an arguably very risky navigational area—and we now had the added requirement of a third adult for passages,” Behan said. “In the end, we didn’t renew at all, and currently have liability-only insurance. I’m not pleased about that and hope to get back to full hull insurance when the market comes around.”

Owners of newer boats don’t seem to be having an easier time either. “We bought a 2015 Jeanneau 64 in October 2020,” Dan Stotesbery said. “I have a lot of experience sailing, but none of it was logged, so I don’t have any credentials like a Yachtmaster or anything like that. My wife has even less experience. When we heard it was tough getting insurance, we were definitely worried about getting covered. Complicating the situation was that the boat was in Turkey, and I needed to sail it across the Atlantic to get to my wife and family. We reached out to the company that insured our house to see if they could find us a company that would insure the boat and especially the crossing. We received two quotes back and ended up getting insured with Concept Special Risk. They did put in a lot of stipulations, like we needed to have a captain for the crossing and at least two other people with bluewater experience, a list of countries we aren’t allowed to go in, and a 250-miles-from-land limit once the crossing was complete. It was extremely expensive, and there was an additional cost for the crossing.”

Changing Marketplace

So how did it get to this point? “We need to put it into context of a market that was very soft for many years—underwriters were looking for business,” Wells said. “There was a bit of a hiccup in the mid-2000s with some fairly significant storms, but generally it didn’t cause much change, and underwriters were still looking for ways to say yes. But then in 2017 came hurricanes Irma and Maria, then Dorian in 2019—these were extremely large losses to very large fleets of boats. Since 2017 we have seen the market flip from a soft to a hard market, and in fact, a very hard market by early 2021. We really have a big change now with fewer insurance companies and greater demand for insurance. And the pricing is much higher than it was a year ago. Irma and Maria showed the vulnerability in the market.”

Laura Lindstrom-Croop from Legacy Underwriters, noted that “many insurance companies left the Caribbean market in 2019-20. Pantaenius America was the first to leave,” she said. “The agency that I work with had YachtInsure, which lost its underwriter, Aspen Insurance, last summer. They have recently secured a new carrier, Clear Blue Specialty, that is writing new business but has new guidelines. Our second underwriter, Concept Special Risk, lost its company, Great Lakes Insurance, on January 1, 2021, but now it has a new company, Clear Springs Property and Casualty, that is writing new business with new guidelines.”

Suzanne Redden, mid-Atlantic branch manager for Gowrie Group, has had a similar experience. “Traditionally, when we would have someone coming in with a sailboat who wanted to do extended cruising, we had five, six, seven…at least that many companies who were willing to write that policy,” Redden said. “So there really wasn’t too much of an issue finding coverage for the customer, depending on where they wanted to go and their level of experience, that sort of thing. What we’re really struggling with now—and it’s a struggle—is that so many carriers have basically pulled out that our options are very limited as far as who is willing to write Caribbean navigation and worldwide navigation. Our choices are few. And what happens then is, of course, the prices go up because the company’s philosophy is ‘no one else wants to write here; we’ll write here, but this is what our actuaries tell us it’s going to cost to allow us to do that.’ So that’s why the rates have gone up.”

The cost to insure his Jeanneau 64 was definitely a bit of a surprise to Stotesbery: “The policy had to be paid upfront. That was the biggest surprise to us because we are used to paying car insurance monthly. This is also a hurdle that I think can be hard to overcome for some people. Not a lot of people have that kind of cash on hand to just fork out.”

Read More: How-To

Underwriting Difficulties

Along with higher costs, Redden also pointed out that the underwriting has changed a lot too. “Where before you would have had somebody who maybe had just a year or two experience, or they had just bought a boat, more companies would have been willing to let them take a trip. They look at it much more closely now when a new submission comes in. That’s made it more difficult, I think, for that sort of person to find insurance.”

According to Emma Whittemore, a service manager for BoatU.S./Geico Marine Insurance, underwriting has become much more sophisticated. “With the growth of data, insurance companies can really tell what group is a high-risk group,” she said. “We’re monitoring a lot more to make sure that the right people are behind the helm on these big, 35- to 60-foot boats. We want to make sure it’s not these customers’ first boat, and that they really know what they’re doing. Underwriting is fluid, but in general we always like to look at the ownership experience.”

This has been a particularly vexing problem for potential cruisers. Dana Fairchild and her husband live in Minnesota and have been planning for their cruising dream for the past few years. The couple has taken ASA sailing courses and chartered on Lake Superior but never owned their own sailboat. “Our cruising plans are to buy a boat large enough to live aboard; a 35- to 38-foot Island Packet is what we have in mind,” she said. “Due to the price point of Island Packets, we are looking at models from the 1990s. We plan to keep it on the East Coast of the US—somewhere above the hurricane zone during hurricane season, and probably down to Florida in the winter—for the first six months to a year while getting comfortable with the boat and used to the liveaboard lifestyle. After that we want to head to the Bahamas for a while, and eventually work our way down to the rest of the Caribbean and stay there.”

While the couple hasn’t purchased a boat yet, they’d heard the news that insurance might be difficult to find, so they reached out to a few companies to explain their plans and intended boat. “The short answer to what we’ve been hearing from insurance agencies is no. The reason for this is predominantly that we have not owned our own boat that is of comparable size, or at least within 10 feet. They don’t take into consideration that we have sailed and chartered boats of the same size, but really only want to see that a boat of comparable size was titled to us for at least two years”

Looking Ahead

So when faced with a denial, a notice of nonrenewal or a steep increase in premiums, what can a cruiser do? Is there coverage available? “What I am seeing, you have more choices if you limit your cruising to the US East Coast down to the Turks and Caicos,” Lindstrom-Croop said. “If you go to the Eastern Caribbean, you have fewer carriers, and some are writing coverage that doesn’t include hurricanes.

“I think cruisers are going to have to be patient and flexible. Also, update your sailing resume so when you shop around, you are giving the company a reason to give you the maximum credit available. Lower rates are probably not going to happen for a couple of years, climate change is weighing heavily on insurers, and the large number of storms recently is worrisome.”

Communication is crucial. Each of the insurance professionals I spoke with made it clear that underwriters are looking much more closely than in years past, and detailed sailing resumes and hurricane plans can help your chances. For newer cruisers, scaled-back sailing plans could help as well because finding coverage for a smaller cruising area will likely be much easier than, say, the entire East Coast and Bahamas. And for older vessels, a survey might be required for renewal.

“Some of the companies have gone to where they won’t write a boat over 40 years old,” Redden said. “Gowrie Group offers the Jackline program, which is a cruising program through Markel Insurance, which is really one of the last US companies still doing extended cruising, but they’re very restrictive on what they will write and how they’ll write it. But they will take older boats. Experience is the key.”

“It is harder to insure an older boat, but it can be done,” Lindstrom-Croop said. “There are just fewer markets. An older boat needs to be maintained well and have a current survey, within three years. I like to submit the survey along with the application when marketing so the underwriters can see the boat.”

For the time being, it seems that cruisers, such as Stotesbery, who currently have—albeit expensive—coverage are doing what they can to keep it. “We have had several major repairs to do on the boat, which we probably could have put in a claim for, but we are too worried about getting dropped or not covered next year, so we just paid for the repairs,” he said. “So it’s sort of a Catch-22. Unless we have a catastrophic type of claim, we don’t want to make one, but we still pay the high premium without really being able to take advantage of the protection. We will definitely start shopping again once we get closer to our renewal date. Unfortunately, there just aren’t a lot of insurance choices out there, so it is quite limiting, and they hold all of the cards.”

Others, such as the Giffords, are going without full coverage for now, while potential cruisers, such as the Fairchilds, might need to put their dream on hold. “As for how this is impacting our plans, it has really made us start to second-guess that this is even a possible plan. We have become discouraged, and this has really put a halt to most of the steps we were taking,” Fairchild said.

Wells, Redden and Lindstrom-Croop are optimistic for things improving in the insurance market over the next year or so, but all emphasize having patience. “We’re hoping that things will change for the better,” Redden said. “We’ve got some companies now that pulled out that are coming back, but it’s a very slow process.”

Jennifer Brett is CW’s senior editor.

- More: Hands-On Sailor , How To , marine insurance , news , print 2021 may

- More How To

3 Clutch Sails For Peak Performance

It’s Time to Rethink Your Ditch Kit

8 Ways to Prevent Seasickness

How To De-Winterize Your Diesel Engine

Kirsten Neuschäfer Receives CCA Blue Water Medal

2024 Regata del Sol al Sol Registration Closing Soon

US Sailing Honors Bob Johnstone

Bitter End Expands Watersports Program

- Digital Edition

- Customer Service

- Privacy Policy

- Email Newsletters

- Cruising World

- Sailing World

- Salt Water Sportsman

- Sport Fishing

- Wakeboarding

How Much Does Liveaboard Sailboat Insurance Cost?

Last Updated by

Daniel Wade

January 26, 2024

In most cases, liveaboard sailboat insurance costs a fraction of what you'd pay for auto, home, or renter's insurance.

In this article, we’ll cover the average cost of sailboat insurance, along with cost considerations, types of coverage, and how to find an affordable plan. We’ll also overview several ways to improve your sailboat to qualify for discounts.

Liveaboard sailboat insurance typically costs between $200 and $500 per year. Premiums vary based on how much coverage you need, the value of your boat, and personal factors such as accident history.

We contacted 3 of the largest and most well-known sailboat insurance companies (Geico, Progressive and USAA) to aggregate this data and determine a real average cost of liveaboard sailboat insurance in the U.S. We also used insurance company data to find the best ways to upgrade your boat to reduce your premiums.

Table of contents

Is Sailboat Insurance Mandatory?

Many people wonder if they're legally required to insure their sailboat. After all, most states require auto insurance, so it follows that boats also require it. However, in most places, you don't need insurance to own or operate a sailboat. That said, purchasing sailboat insurance is still the responsible thing to do.

Liveaboard vs. Standard Sailboat Insurance

Is there a difference between standard sailboat insurance and liveaboard sailboat insurance ? Generally speaking, no, but some insurance companies might have additional coverage requirements for people who use the coat as their primary residence.

This is primarily because liveaboards spend way more time 'using' their boats. When choosing a plan, be sure to talk to an agent to determine the insurance company's precise definition of 'use.' Doing so can help save time and money, as you may only be required to disclose how often you plan to actually sail the vessel.

Some indemnity companies don't require you to specify how often you use the vessel. In these cases, there should be no difference in the cost or coverage amounts.

Should I Buy Liveaboard Sailboat Insurance?

Many sailors wonder if it's worth purchasing liveaboard sailboat insurance. It's a good question to ask, as the majority of boat owners take a very passive (and frankly, careless) approach to sailboat insurance.

The fact of the matter is that most sailboats never get into a serious accident. That said, sailboats that do get into accidents often suffer a lot of expensive damage. Additionally, sailboats that cause accidents can be on the hook (along with their owners) for thousands of dollars. If someone gets injured, the costs multiply rapidly.

But what about insurance for coats that rarely ever leave the marina? Believe it or not, insurance is just as important for stationary liveaboard sailboats. The first reason that comes to mind is that you'll be covered if another boat causes damage to yours. If they're the dishonest type and leave the scene, you won't be on the hook for the damage they cause.

After weighing the facts, it's evident that the relatively low expense required to get liveaboard sailboat insurance is more than worth it, and it's an essential part of responsible boat ownership.

Benefits of Liveaboard Sailboat Insurance

What else does liveaboard sailboat insurance protect you from? As we discussed previously, sailboat insurance is an excellent way to protect your property and shield yourself from financial liability in the event of an accident.

But as every sailboat owner knows, accidents aren't the only thing that causes damage to sailboats. Another benefit of liveaboard sailboat insurance is protection from storm damage. After all, your boat is your home, and you'd want to keep it safe from storm damage costs just like your car.

Coverage for storm damage isn't necessary everywhere. In the San Francisco or Los Angeles area, where the weather is almost always mild, storm insurance isn't a huge priority or expense.

However, places with frequent thunderstorms and hurricanes (such as Florida and the Carolinas) are areas where liveaboards should consider getting extra storm coverage. Nothing ruins your day like a storm surge or a baseball-sized hail hole in your beautiful teak deck.

Liveaboard sailboat insurance is also useful in events such as fires or when an accident happens at the marina. For example, insurance may cover you if a component of a dock breaks or a cover collapses and causes damage to your boat.

Also, if somebody else's boat catches fire and the heat causes damage to your boat, you'll be covered. These situations do happen, which is why it's important to cover all of your bases.

Liveaboard Insurance Cost Considerations

What contributes to the cost of liveaboard sailboat insurance? Purchasing insurance for a sailboat is a lot like buying car insurance, except it's likely to be a lot less expensive when it's all said and done.

Insurance companies take several things into account when issuing you a quote. The first thing they consider is the size and value of your sailboat. Obviously, a 40-foot priceless classic schooner will probably cost more to insure than a fiberglass 1971 Catalina 22.

However, that's likely not the most important factor. Insurance companies also consider your deductible and how much coverage you need. In fact, these two factors are likely the most influential when it comes to determining your annual premiums,

Location is another factor considered by insurance companies. Some states have notoriously high insurance premiums. This is often due to a combination of state regulation and analysis of how often people wreck their coats in the area.

Some parts of the country are known for heavy boat traffic. Combine that with a proclivity for bad weather, and you're likely to encounter steeper insurance premiums.

The final consideration is your personal history and how often you plan to use your sailboat. As we discussed earlier, having a history of accidents can negatively affect your ability to find an affordable sailboat insurance plan.

Average Cost of Sailboat Insurance Plans

The cost of liveaboard sailboat insurance plans varies widely. For the sake of simplicity, we'll base our estimates off of the typical cost to insure an average liveaboard sailboat. The majority of people who live aboard do so on boats between 26 and 45-feet in length.

With that in mind, we estimate that the average semi-experienced liveaboard sailboat owner will pay between $200 and $500 per year. Compared to car insurance, sailboat insurance is actually quite affordable. However, your individual boat may cost more to insure. This is especially true if you sail a lot, long distances, or in hazardous areas.

How to Reduce the Cost of Liveaboard Sailboat Insurance

Reducing the cost of liveaboard sailboat insurance can be quite easy, especially if you don't plan to sail very often (or very far). The easiest way to reduce your premiums is to reduce your deductible. The same applies to car insurance, as most kinds of vehicle insurance work the same way; here are a few more ways to reduce your sailboat insurance premiums.

Take a Boater's Safety Course

In some states, you're not required to have a boater's license for a sailboat. These states seem to dwindle in number every year, but it's possible that you live aboard and have never been licensed. Many insurance companies offer discounts if you take a boater's safety course, so it's worth considering.

Buy a Newer Boat

Insurance companies often offer discounts for newer boats. That said, newer boats tend to be costlier, so there's a point at which the insurance savings from owning a newer boat don't make up for the additional purchase price. If you already have a newer boat, inquire about possible discounts.

Install Safety Systems

Advanced safety and navigation systems reduce the risk of an accident. As a result, insurance companies often offer discounts to people who install systems such as radar, fume detectors, and automatic fire suppressors.

Additional safety and navigation systems, such as GPS systems, locator beacons, depth finders, smoke/CO detectors, and EPIRBs, can also reduce your rates.

Choose a Sailboat with a Diesel Inboard Engine

So, how can having a diesel engine save you money on your insurance premiums? Unlike gasoline, diesel is usually not explosive, and its fumes don't prevent as big of a fire hazard.

This applies only to vessels with an inboard engine. There aren't any widely-available diesel outboard engines, and some sailboats have no engine at all. Explosions and gasoline fires are more common on boats than most people expect, and insurance companies are particularly risk-averse when it comes to fuel.

Inspect and Repair Engine Safety Systems

Similarly, you can reduce your insurance premiums by updating your engine safety and fume abatement systems. These systems prevent gasoline fumes from collecting in closed areas, which greatly reduces the risk of fire. Most states require these systems, and updating them is a good idea regardless.

Will My Driving Record Affect My Premiums?

Many people wonder if their driving records will impact their sailboat insurance premiums. In most cases, the answer is a resounding "yes." If you have a stellar driving record and lots of years on the road, you can expect to pay less than your younger or less experienced counterparts.

If you have a history of accidents, a DUI/DWI, or other issues, you'll likely pay more (at least for a while). The longer you stay safe and responsible, the lower your rate will be.

On a similar note, your age can have a significant impact on the price of liveaboard sailboat insurance. Younger people, specifically in their late teens and early 20s, usually have to pay higher premiums. This is because people in that age range (and younger people in general) are far more likely to cause an accident.

The best way to avoid paying more because of your driving record is to keep it clean, avoid alcohol, and take driver's or boater's safety courses whenever possible. A ticket can have a ripple effect across all of your insurance plans, so it's best to get them expunged with courses whenever possible.

Shopping for Liveaboard Sailboat Insurance

A prudent insurance buyer always shops around to find the best rates. Most major insurance companies now have free online quote tools, which we find are fairly accurate. You don't have to purchase anything to use them, and they can help you find the best rate in minutes.

Some insurance companies offer hefty discounts for loyalty. If you're currently insured in any way, contact your insurance agent and inquire about adding a boat to your plan. Companies that offer insurance "bundles" are incentivized to save you money in the long run if you continue to work with them.

Marine Insurance Companies

Your first inclination when shopping for sailboat insurance may be to work with a big-name auto indemnity company. And while it may turn out to be the best option, you should also consider working with a specialized marine insurance company. These companies, such as BoatUS and United Marine, offer services that aren't available through traditional insurance companies.

Chances are you've seen coat towing and repair vessels speeding around your local waterway at some point. These vessels work with marine insurance companies, and they're extremely useful for sailors. These insurance plans offer on-the-water services such as towing, engine repair, and parts delivery.

In some cases, working with a marine insurance company can provide these benefits and save you money too. If you ever run aground, break a stay, or need a new battery, these insurance plans have you covered. Emergency towing and repair on the water can be obscenely expensive without insurance, so it's smart to bundle it all together when possible.

Related Articles

I've personally had thousands of questions about sailing and sailboats over the years. As I learn and experience sailing, and the community, I share the answers that work and make sense to me, here on Life of Sailing.

by this author

Financial and Budgeting

Most Recent

What Does "Sailing By The Lee" Mean?

October 3, 2023

The Best Sailing Schools And Programs: Reviews & Ratings

September 26, 2023

Important Legal Info

Lifeofsailing.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon. This site also participates in other affiliate programs and is compensated for referring traffic and business to these companies.

Similar Posts

Best Bluewater Sailboats Under $50K

December 28, 2023

How To Choose The Right Sailing Instructor

August 16, 2023

Cost To Dock A Sailboat

May 17, 2023

Popular Posts

Best Liveaboard Catamaran Sailboats

Can a Novice Sail Around the World?

Elizabeth O'Malley

June 15, 2022

4 Best Electric Outboard Motors

How Long Did It Take The Vikings To Sail To England?

10 Best Sailboat Brands (And Why)

December 20, 2023

7 Best Places To Liveaboard A Sailboat

Get the best sailing content.

Top Rated Posts

Lifeofsailing.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon. This site also participates in other affiliate programs and is compensated for referring traffic and business to these companies. (866) 342-SAIL

© 2024 Life of Sailing Email: [email protected] Address: 11816 Inwood Rd #3024 Dallas, TX 75244 Disclaimer Privacy Policy

- CREATE AN ACCOUNT

- Boat Cover Finder

- Bimini Top Finder

- Boat Propeller Finder

- Engine Parts Finder

- Anchor & Dock

- Watersports

- Clothing and Footwear

- Engine Parts

- Cabin and Galley

- Covers and Biminis

- Electronics

- Paint and Maintenance

- Pumps and Plumbing

- Anchor Chains & Ropes

- Boat Fenders

- Boat Mooring

- Boat Protection

- Dock Storage & Protection

- Ladders, Steps, & Platforms

- Top Sellers

- Fishing Rods

- Fishing Reels

- Fishing Rod & Reel Combos

- Fishing Tools & Tackle Boxes

- Fishing Line

- Fly Fishing

- Fishing Bait & Fishing Lures

- Fishing Rod Holders & Storage Racks

- Fish Finders, Sounders & Sonar

- Trolling Motors

- Fishing Nets

- Fishing Downriggers & Acessories

- Fishing Outriggers & Acessories

- Fishing Kayaks

- Fish Cleaning Tables

- Inflatable Rafts

- Paddle Boarding

- Paddles & Oars

- Wakeboard, Wakesurf & Ski

- Wakeboard Towers

- Tow Ropes & Handles

- Life Jackets & PFDs

- Snow Sports

- Roof Racks, Carriers, Dollies

Men's Clothing

- Accessories

Men's Footwear

- Atheltic Shoes

- Water Shoes

Women's Clothing

- Dresses & Skirts

Women's Footwear

- Fuel Systems

- Sacrificial Anodes & Zincs

- Generator Parts

- Inflatable Boats

- Propeller Parts & Accessories

- Boat Manuals

- PWC Parts & Accessories

- Fishing Boat Seats

- Offshore Boat Seats

- Ski Boat Seats

- Pontoon Boat Seats & Furniture

- Boat Seat Pedestals & Hardware

- Boat Seats by Manufacturer

- Boat Tables & Hardware

- Boat Seat Covers

- Boat Seat Vinyl

- Floating Boat Cushions

- Barbeque Grills

- Boat Drink Holders

- Cabin Accessories & Hardware

- Boat Ventilation

- Interior & Cabin Lighting

- Marine Teak Products

- Carbon Monoxide & Smoke Detectors

- Binoculars & Telescopes

Boat Bimini Tops

- Bimini Top Accessories

- Pontoon Bimini Tops

- Other Biminis

- RV & Trailer Covers

- Boat Shrink Wrap & Accessories

- Boat Shelters

Boat Covers

- Boat Cover Accessories

- Boat Lift Canopy Covers

- Other Covers

- Boat Wiring & Cable

- Marine Batteries & Accessories

- Marine DC Power Plugs & Sockets

- Marine Electrical Meters

- Boat Lights

- Marine Electrical Panels & Circuit Breakers

- Power Packs & Jump Starters

- Marine Solar Power Accessories

- Marine Electrical Terminals

- Marine Fuse Blocks & Terminal Blocks

- Marine Switches

- Shore Power & AC Distribution

- Marine Audio & Video

- GPS Chartplotters & Accessories

- Electronic Navigation Charts & Software

- Digital Instruments

- Display Mounts

- VHF Radios & Communication

- Marine Radar

- Auto Pilot Systems

- Action Cameras

- Fiberglass & Epoxy Boat Repair

- Boat Paint & Varnish

- Marine Adhesives, Sealant, & Caulking

- Marine Engine Maintenance

- Boat Cleaners & Waxes

- Boat Cleaning Supplies

- Fresh Water Boat Systems

- Bilge Pumps

- Marine Plumbing Parts

- Wash Down Pumps

- Livewell Aerator Pumps & Live Bait Wells

- Toilet & Waste Pumps

- Marine Pump Replacement Parts

- Tires, Rims, & Hub Kits

- Boat Trailer Winches

- Boat Motor Supports & Transom Savers

- Boat Trailer Guides & Rollers

- Boat Trailer Fenders

- Boat Trailer Lights

- Boat Trailer Hardware

- Boat Trailer Jacks

- Boat Trailer Brakes & Axles

- Boat Trailer Tie Downs

- Couplers, Mounts, Hitches, & Locks

- Boat Deck Harware

- Marine Nuts, Bolts, & Screws

- Boat Handles, Pulls, & Rings

- Prop Nut Kits & Hardware

- Boat Cabin Hardware

- Marine Fasteners

- Boat Windshield Parts

- Boat Tubing & Rails

- Boat Mirrors

- Marine Tools & Tool Kits

- Boat Lettering

- Women's Clothing Deals

- Men's Clothing Deals

- Fishing Deals

- Anchor & Dock Deals

- Electrical Deals

- Electronics Deals

- Paint & Maintenance Deals

- Pumps & Plumbing Deals

- Boat Seats Deals

- Trailering Deals

- Camping & RV Deals

- Dealer Login

- Forums Login

- Search forums

- General Boating/Outdoors Activities

- Boat Topics and Questions (not engine topics)

Boat insurance - experience?

- Thread starter danond

- Start date Aug 1, 2008

Lieutenant Junior Grade

- Aug 1, 2008

How many of you have boat insurance, and of those who do and have had to use it, what was your experience? I didn't even know it existed until this year. I just called and it's dirt cheap, $150/year for my craft. Have any of you had a blown drive covered, or something major? How did it go?

Lieutenant Commander

Re: Boat insurance - experience? God...I sure as heck hope we ALL have boat insurance! And I'm not talking about worrying about insuring an older inexpensive boat...that's very optional. But I'm talking about boaters liability insurance. Isn't that law almost everywhere anyway? Maybe not...but I sure wouldn't go out without it. I assure you your homeowners or auto insurance policy won't cover a boat accident (unless you pay extra for an endorsement at some companies). So if you don't have boat liability insurance, buy it TODAY! God forbid you accidentally run over a child swimming or a downed skiier in the lake that you didn't see, you will likely be sued for everything you own...and lose it all. Mine is thru American Family Insurance. $116/year for full coverage including $100K/$300K liability, medical payments, and boat damage with $500 deductible, for a 1992 18 foot runabout. On top of that I have a $2 million umbrella policy that takes over in the case that my liability limits are exhausted (would YOU settle for a mere $100,000 if you witnessed your child being shredded to death by another person's propeller?) Most wouldn't. So the extra $2 million protects me from losing my entire financial life in the horrifying situation that I accidentally do such a thing to somebody else. The umbrella costs about another $150/year, and it puts a $2M liability coverage on all of my cars, boat, snowmobiles, motorcycle, and homeowners liability policies. As far as I'm concerned, anyone who actually has something to lose (like a home and a 401K account?) NEEDS a policy like that. I had one claim a couple years back...a strange one. I crashed hard while waterskiing (picture a 60 mph bellyflop into the water while I was shooting over wakes on a slalom...the boat itself did nothing wrong and hit nothing. I just fell.) I broke some ribs. A friend was driving the boat at the time...no fault of his at all. I just fell badly. Initially my health insurance paid for my xrays and doctor visits, but later I got a notice from them that basically said "if you have boat insurance, please provide us with your policy number, as we'd like to ask them to reimburse us for what we paid to handle your injury." So I filed a claim and gave copies of all my doctors bills to the boat insurance company. American Family reimbursed my health insurance company 100% immediately. They even later sent me a $40 check to reimburse me after they noticed I paid two doctor visit copayments...and I didn't even ask them to! No deductible. That was a very legitimate medical payments claim that should have been paid by my boat policy all along. My rates never changed. I was, and still am, pleased with 'em.

Re: Boat insurance - experience? I'm getting it on Monday, no doubt. Granted, covering crazy bodily injury accidents that can happen is a big deal, I guess for whatever reason it's just something that never came up for me, and since it's not required in North Dakota (neither is a title for the boat, physical ownership is 9/10th's the law). Call me stupid and let's move on. I'm wondering, I hear about people spending huge $ fixing their blown drive systems or they spin bearings in the engine, etc. Basically any big, mechanical failure: Does it cover that stuff, too? I asked them if it did, they said yes, though I haven't seen paperwork or read any fine print so I'm still skeptical. It would be GREAT if it does. I'm always so damned paranoid about "improper, sudden removal" of the lower unit.

modernrocketry

Petty officer 2nd class.

Re: Boat insurance - experience? I have 2 boats insured with BoatUS: 1. 41' Roughwater Pilothouse motoryacht Diesel powered -- Southern California Coastal waters it runs be $1200.00 per year with 1M\500k liability 2. 14' Novurania RIB with OMC 115hp TurboJet drive it runs $230.00 per year with 500K/250k liability both boats have full coverage with an agreed hull value. I contact State Farm about insuring the Novurania (they don't insure diesel boats in California) even with Multi-policy discount -- I have Car and Home with them -- they were higher than BoatUS I have heard that blue water boats (ocean going) in hurricane areas rates are getting crazy.

DRIFTER_016

Petty officer 1st class.

Vice Admiral

Re: Boat insurance - experience? I have rider on my house insurance, doesn't cover breakage to my boat but if I should hit someone else I am covered.

triumphrick

Re: Boat insurance - experience? Years ago while cruising in the shallows I snagged a crab trap that seized my lower unit and threw a rod in my old Merc 100. Allstate paid $800 for that claim without an increase in the policy. I have been with them for years and have never filed another claim. The total cost on this older rig is $162 a year.

Re: Boat insurance - experience? A regular mechanical failure and they are not going to pay. If you hit something, run aground, etc. insurance will pay. You choose to not maintain your boat and the block freezes in January or the engine overheats because the impeller died then you are on your own.

danond said: I'm wondering, I hear about people spending huge $ fixing their blown drive systems or they spin bearings in the engine, etc. Basically any big, mechanical failure: Does it cover that stuff, too? I asked them if it did, they said yes, though I haven't seen paperwork or read any fine print so I'm still skeptical. It would be GREAT if it does. I'm always so damned paranoid about "improper, sudden removal" of the lower unit. Click to expand...

modernrocketry said: I have 2 boats insured with BoatUS: I contact State Farm about insuring the Novurania (they don't insure diesel boats in California) even with Multi-policy discount -- I have Car and Home with them -- they were higher than BoatUS I have heard that blue water boats (ocean going) in hurricane areas rates are getting crazy. Click to expand...

Re: Boat insurance - experience? State Farm is who I called. I'll post an update on Monday after I get a copy of the policy. Edit: it was Allstate, not state farm, and it appears they do have the "only if it's a racoon" style policy.

You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Boat Insurance

Start a boat insurance quote and get out on the water..

Or continue previous quote .

Manage Your Boat Insurance Policy

GEICO Marine (formerly Seaworthy) Policyholders

- Log in to GEICO Marine to manage your policy or call (877) 581-BOAT (2628)

- Mon - Fri 8:00 am - 10:00 pm, Sat - Sun 8:00 am - 9:15 pm

SkiSafe Policyholders

- Log in to SkiSafe to your policy or call (800) 225-6560

- Mon - Thu 9:00 am - 7:00 pm, Fri 9:00 am - 6:00 pm, Sat 9:30 am - 5:30 pm

Or call us at (800) 841-3005

Need a boat insurance quote?

Existing boat policyholder?

Get a boat insurance policy to protect your investment.

Boat insurance helps you protect your boat or personal watercraft (PWC) investment. So if you travel across lakes, rivers, or ocean waters of the United States we can help keep your peace of mind afloat. Whether you're looking for a new boat insurance policy or just to save money, we can help you get started with a free boat insurance quote.

Make boating better, together. Experience and a name you can trust go a long way when you're shopping for boat insurance. That's why the GEICO Marine Insurance Company has teamed with BoatUS , the nation's largest group of recreational boat owners. Since 1966, BoatUS has been helping to make boating safer, more affordable, and fun. Together, we share a passion for all things boating.

We all want cheap boat insurance rates, but customer service matters too. Protect your investment with boat insurance you can count on and get your free online boat insurance quote today.

Why do you need boat insurance?

A boat insurance policy helps protect you and your boat. If you don't have a separate boat insurance policy, you're probably underinsured. This could mean paying a lot out of pocket for accidents outside your control. Many homeowners policies cover minor boating risks but don't cover your needs sufficiently due to:

- Size restrictions

- Limitations on horsepower

- Limits on damage coverage

Check out our "boating insurance explained" video and article here for more reasons why boat insurance is a smart idea.

Boat insurance can provide coverage for:

- Damage to your boat including hull, sails, equipment, and more.

- New boat replacement

- Fuel spill liability

- Liability to pay for damages and injuries you cause if you hit another boat, person, dock

- Medical coverage for you and persons in your boat.

- Wreckage removal

What types of watercraft are covered by boat insurance?

All boats aren't the same. You need to customize your boat insurance to meet your needs and provide your watercraft with the proper coverage. Here is a list of the most common types of watercrafts.

- Pontoon boats are one of the most popular inland water boats. They are a flattish boats that rely on floats to remain buoyant. Their wide and spacious area is great for many passengers to enjoy the ride.

- Personal watercraft (PWC) are powered by a water jet pump and the rider generally sits, stands, or kneels on it. There are many types of PWCs which include WaveRunners, Sea-Doos and more.

- Fishing and bass boats are designed and equipped for fishing. Most are powered by an outboard motor and are equipped with power poles, trolling motors, etc.

- Powerboats are the most popular type of boat used for cruising, watersports, and so much more.

- Sailboats are propelled partly or entirely by sails.

If you don't see your watercraft listed and are looking for more information on different types of boats and insurance for boats, check out our boat FAQ page .

What does boat insurance cover?

A policy insures your boat against damage and loss caused by common risks, such as collision, fire, storms, and theft. Boat insurance may also help protect you if you accidently injure someone or damage their property with your boat.

Service and Claims

When you choose GEICO Boat Insurance, you have access to:

- Licensed agents as passionate about boating as you are

- Expert service including 24/7 claims handling and towing

- Experience you can rely on

24/7 Boat Towing*

GEICO Marine Insurance Company has teamed with TowBoatUS, the nation's largest towing fleet to provide:

- 24/7 boat towing assistance

- On the water towing services provided by TowBoatUS

- Fuel delivery services

- Digital dispatch through the BoatUS app and more

Personal Watercraft (PWC) Insurance Coverage

You can get a boat policy for your PWC. Typical PWC insurance coverage includes:

- Damage to another craft or dock

- Physical damage to your watercraft

- Towing assistance

How much does boat insurance cost?

Boat insurance is based on the type of boat, length, number of engines and horsepower, how you use it (recreation, commercial charter, racing, etc.), and how and where it will be stored. All of these factors, including the experience and claims record of the owner will factor into the cost of boat insurance.

You could save even more with these boat insurance discounts.

We know discounts and our watercraft insurance agents can help you get them to help you save on your boat insurance quote.

Multi-Policy Discounts

If you're a current GEICO Auto Insurance policyholder, you could save on your boat insurance .

Boat Safety Courses

We know that safety comes first when you're having fun on the water. When you pass boat safety courses, you could save money on your boat insurance.

Need to speak with a boat insurance sales representative?

You can reach us at (855) 395-1412

- Mon - Fri 8:00 AM - 10:00 PM (ET)

- Sat - Sun 8:00 AM - 9:15 PM (ET)

Boat Insurance: Get the answers you're looking for.

- Is boat insurance required? Boat insurance liability coverage is only mandated in a few states, so always check insurance requirements for the state you're boating in. Physical damage coverage is required by your lender if you're financing your boat or watercraft. If you keep your boat at a marina, the marina may require you to have liability coverage.

- Liability to pay for damages and injuries you cause if you accidentally hit another boat, person, or dock

There are some types of watercraft that can't be added to a new or existing GEICO boat policy:

- Airboats, amphibious land boats or hovercraft

- Boat with more than 4 owners

- Boats over 50 feet in length

- Boats over 40 years old

- Boats valued over $2,500,000

- Floating homes

- Homemade boats

- Houseboats that do not have motors

- Steel hulls

- Wooden hulls

- Watercraft previously deemed a constructive total loss

- Does boat insurance cover theft? Our Ageed Hull Value, and Actual Cash Value policies protect against damage to your watercraft from incidents out of your control, including theft.

- How do I make a payment or manage my boat insurance policy? Managing your boat insurance policy and making payments is easy in the BoatUS app. You can also manage your policy or make payments online , or by calling (800) 283-2883 .

- How do I report a claim on my boat insurance policy? You can report your claim through the BoatUS app. Claims can also be reported online , or by calling (800) 937-1937 .

GEICO has teamed up with its subsidiary, BoatUS, to bring boaters a policy developed by experts, with the great service you expect from GEICO. Policies are underwritten by GEICO Marine Insurance Company. BoatUS—Boat Owner's Association of The United States—is the nation's largest association for recreational boaters providing service, savings and representation for over 50 years.

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages. Some discounts, coverages, payment plans, and features are not available for all customers, in all states, or in all locations.

*Boat and PWC coverages are underwritten by GEICO Marine Insurance Company. The TowBoatU.S. Towing Coverage Endorsement is offered by GEICO Marine Insurance Company, with towing services provided by the BoatU.S. Towing Program. Towing coverage only applies to the insured watercraft.

Colorado Language Preference

Are you a resident of or looking for insurance in the State of Colorado?

We are temporarily unable to provide services in Spanish for Colorado residents. You will now be directed to an English experience.

Estamos encantados de ofrecer nuestra nueva version del sitio web en Español. Apreciamos su paciencia mientras seguimos mejorando su experiencia.

The True Cost of Living on a Sailboat: Our Monthly Expenses

As an Amazon Associate, we earn from qualifying purchases. We also earn from other affiliate websites. See our full disclaimer .

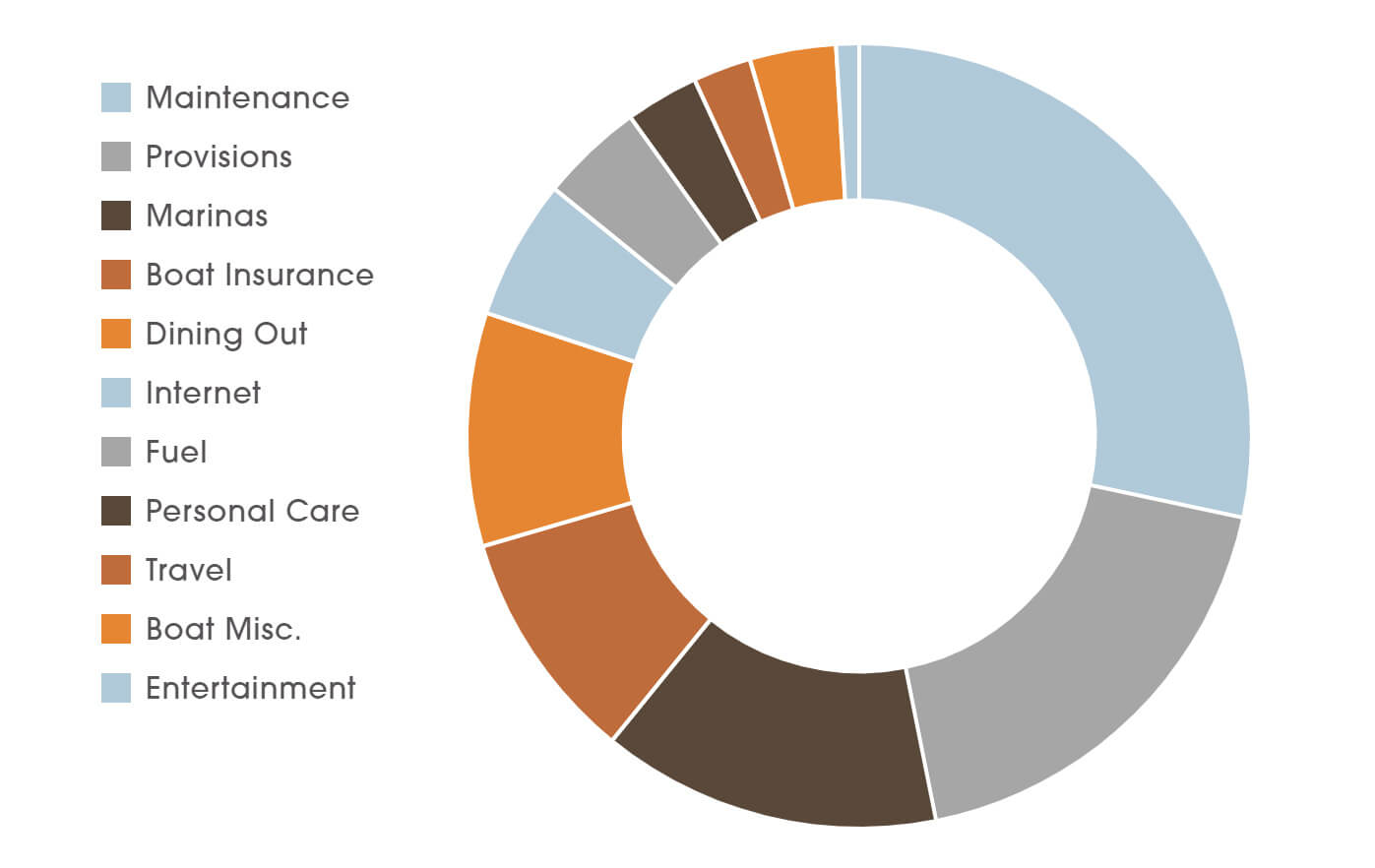

How much does it cost to live on a boat? This was my biggest question when we were planning and saving to cruise. I was clueless when it came to creating a budget for our future life aboard. I was looking for someone to tell me exactly how much it would cost ME to live on a sailboat full-time.

I quickly learned some people cruise for less than $1,000 a month and some for upwards of $10,000 a month. Most are somewhere between.

Not so dissimilar from living on land, different people cruise on all sorts of budgets.

For us, our cost of living on a sailboat isn’t so far from our land-based spending.

Part of this journey was learning to live with less, but we still maintain some creature comforts on the water.

Here is a breakdown of our cost of living on a boat full-time while cruising the US east coast.

Cost to Live on a Sailboat

Average cost of $2,424 per month*

Sailboat Maintenance Expenses

Average cost $1,006.

Maintenance, Parts & Tools ($687)

It’s no surprise boat maintenance is top of the list.

You will continuously be fixing broken things or maintaining things on a sailboat. You will also need different tools, spare parts, cleaners, etc., as you cruise.

There will be months when you won’t need much in the way of tools and parts (especially if you already have a lot of tools and spare parts onboard). Then in one month, you might spend 40% of the annual budget.

We make a strong effort to do most boat projects ourselves.