Yachts and Malta – Tax, VAT and all that goes with it

The past few years have seen numerous published articles talk about Malta being the number one EU destination for maritime excellence. Many of these articles concentrate on the niche area of what makes Malta advantageous for commercial and pleasure yachting, so in this article I thought it would be both interesting and useful to pull together some of the key details into one place to allow readers to get an overall feel of what Malta (as a maritime jurisdiction) is all about – particularly from a tax perspective.

VAT Inspections

As tax authorities around the globe seek new ways to strengthen their controls over business transactions within their jurisdictions, VAT is becoming a wider issue every day with more and more governments being forced to oppose the shadow economy in order to receive the money they are owed based on existing legislation. Needless to say the yachting industry has seen its own fair share of controversy and knee jerk reactions in this regard.

There also still remains some individuals, inexperienced in the ownership and operation of a yacht, who are of the opinion that if a yacht is owned through a VAT registered company, they can recover any and all VAT incurred on the cost of purchasing and running of the yacht by merely chartering it out a few times a year to friends or family members.

The reality is that tax authorities have now tightened up on rules and inspections so that only bona-fide charter businesses can actually make this work. It is becoming the norm for customs authorities in many of the Mediterranean ports to carry out unannounced inspections to review log book entries, look in detail at charter contracts, request proof of prior payment of charter fees and review importation documentation (DAU) for offshore registered yachts; all with the intention of proving whether or not a charter is genuine.

Importation

The importation of a yacht, intended for commercial use, into Malta is subject to the standard rate of 18% VAT. However, there is a VAT deferment scheme available which replaces the need to physically pay over the 18% VAT to the tax authorities. A bank guarantee is required in this case and the guarantee must be the equivalent of 20% of the VAT amount which is due on the importation of the yacht. The bank guarantee has to remain in place for 4 months, after which time it is expected that business activities would have started and a VAT return would have been submitted.

Flag Registry

The Maltese flag is not only a flag of confidence but a flag of choice. Its good standing is not only evidenced by the many leading ship owning and ship management companies who register their vessels here, but also by international banks and financiers who continue to recommend ship registration with the Maltese register. Malta is in fact now home to the largest ship register in the EU and the 6 th largest in the world, and continues to provide a convenient, cost effective and secure choice for yacht owners.

Commercial yachts owned by Maltese or EU citizens or by corporate bodies established in Malta can be registered under the Maltese flag. Non-EU owners can also register a commercial yacht under the Malta flag provided a resident agent (such as Abacus) is appointed.

The administration of the Maltese flag is carried out by Transport Malta, is driven by safety considerations and is fully compliant with international standards and obligations. The flag registration process itself is also highly efficient and allows yachts to provisionally register under the Maltese flag for 6 months, after which time all registration requirements must be fulfilled.

Tonnage Tax

Yachts registered on the commercial register that do not carry cargo and carry no more than 12 passengers may be eligible to benefit from the ‘tonnage tax scheme’. This tax package enables commercial yacht owners to pay a fixed annual tonnage tax in lieu of paying any income tax, depending on the tonnage of the yacht. Yachts in commercial use and in the classes listed below will qualify for the special tonnage tax scheme:

- Yachts of no less than 15m and no more than 24m in length;

- Superyachts of more than 24m and less than 500 gross tonnage (‘GT’);

- Superyachts of more than 24m in length, of more than 500GT but less than 3,000GT.

Yachts under finance

The registration of commercial yachts under the Maltese Flag is also attractive to financiers. Malta boasts of a reliable legislative framew

framework that provides a high degree of protection to financiers, thus assuring peace of mind while facilitating financing opportunities to owners. It is also worth noting that Maltese law permits the insertion of covenants on the mortgage instrument, to limit or prohibit the transfer of the vessel and/or the registration of further mortgages of the yacht without the prior written consent of the financier. Mortgages also provide financiers with self-help remedies such as the right to take possession of the yacht and the right to sell the vessel without taking recourse to complex court procedures. In fact, enforcement procedures contemplated in Maltese law are non-bureaucratic, effective and efficient.

There is an exemption from stamp duty on the registration of a tonnage tax ship under the Merchant Shipping Act. This means that no stamp duty would be chargeable on the sale or transfer of a tonnage tax ship or a shareholding.

In the case that a company does not qualify as a shipping organisation (as described above), the company may claim a 6/7ths refund of the income tax paid in Malta. Malta does not level any withholding tax on the distribution of a dividend. This results in a net effective income tax rate of 5%.

Social Security Contributions

Where a licensed shipping organisation employs persons who are not resident in Malta and who are officers or employees on board a yacht, the organisation in respect of such officers and employees are exempt from any social security contributions payable under the Social Security Act.

Charter activities starting in Malta

Malta continues to emerge as an international centre of excellence for chartering operations backed by a high standard of yachting services and talented pool of professionals. It has a unique geographical position and connectivity to major airports renders Malta an attractive hub for chartering operations.

To sustain the growth of the chartering industry the Malta VAT authorities have implemented a special regime which allows chartering activities to be charged with a reduced rate of VAT. This is subject to certain conditions which include the charter must commence in Malta and the charter period cannot exceed 90 days. VAT on charter

fees may then be calculated on the basis of the length and means of propulsion of the yacht at the following rates:

Motor Yachts

Length % of lease subject to VAT Effective rate of VAT

Over 24 metres in length 30% 5.4%

Between 16.01 and 24 metres 40% 7.2%

Between 12.01 and 16 metres 50% 9%

Sailing Yachts

Length % of lease subject to VAT Effective rate of VAT

Over 24 metres in length 30% 5.4%

Between 20.01 and 24 metres 40% 7.2%

Between 10.01 and 20 metres 50% 9%

Written by Samantha Snow, client services manager at, Abacus Corporate Services Limited.

Subscribe to our free newsletter

For more opinions from Superyacht Investor, subscribe to our email newsletter.

Subscribe here

© Specialist Insight, 2024. All rights reserved. Website design and development by e-Motive Media Limited .

Malta VAT on Yachts

Malta VAT on Yachts can be reduced through a leasing-scheme. This page also includes an overview of the effective rates on Malta VAT on Yachts.

The EU Value Added Tax (VAT) is a form of consumption tax system which applies all throughout all the member states of the European Union. VAT has to be paid on any yacht sailing EU waters unless it falls under the temporary importation relief. The moment at which the VAT has to be paid depends mostly on the ownership of the vessel. Once the VAT is paid by an EU individual or body corporate in one of the EU countries, a yacht can roam around freely throughout all the EU member states. In Malta VAT on Yachts can be mitigated through a system which can reduce the VAT payable to an effective rate of 5.4% depending on the yacht.

Temporary Relief

If a yacht is owned and used by a non EU person but sailed in EU waters a temporary relief is available. Should the owner choose to sail the yacht in EU waters indefinitely, the yacht VAT shall be paid for the purpose of importing the yacht to the EU.

Reducing the Malta VAT on yachts

In Malta, VAT on yachts can be reduced by setting up a Maltese company, which firstly must acquire the yacht and lease it to a third party before finally selling the yacht. The exact rate of VAT that has to be paid depends on the propulsion and length of the yacht. Through this system the owners of the yacht are allowed to sail freely within the EU waters while also benefitting from the savings on the yacht VAT that has to be paid on the value of their yacht.

Effective rates

The effective rates for Malta VAT on yachts are applicable as follows:

- Sailing boats or motor boats over 24 metres in length - 5.4%

- Sailing boats between 20.01 to 24 metres in length - 7.2%

- Motor boats between 16.01 to 24 metres in length - 7.2%

- Sailing boats between 10.01 to 20 metres in length - 9%

- Motor boats between 12.01 to 16 metres in length - 9%

- Sailing boats up to 10 metres in length - 10.8%

- Motor boats between 7.51 to 12 metres in length (if registered in the commercial register) - 10.8%

Get in Contact

Privacy policy.

At Chetcuti Cauchi Advocates, we are committed to the privacy of every client. We recognise that our clients entrust important personal information to us, and we take seriously our responsibility to protect and safeguard this information. Our long-standing privacy policies and practices are described below.

What type of non-public personal information do we collect?

The non-public personal information that we collect relating to individual clients will vary with the purpose and scope of our representation. When we advise a client on personal financial, tax or immigration matters, the information we collect will include:

Information that a client has provided to us

Information about our client or our client's transactions with others, provided by others whom our client has requested or authorized us to contact;

Information about our relationship with and our services to our client

For example, for estate or succession planning, we will typically collect all relevant personal information, including information about our c lient's personal assets, goals and preferences. For tax return preparation, we will collect personal financial information relevant to our client's income and deductions for the relevant year.

What Type of Information Might We Disclose, and To Whom?

As advocates and members of our respective professional associations, we adhere to our professional duty to keep confidential all non-public personal information relating to a client's representation.

Our strict levels of confidentiality are backed by Maltese law, namely the Professional Secrecy Act which has established a high common standard of confidentiality for all professional practitioners. Those who violate professional secrecy may be prosecuted under Section 27 of the Criminal Code and on conviction may be liable to a maximum fine of EUR46,587 and/or a 2 year prison sentence.

Therefore, we do not disclose personal information about any current or former client except if necessary to carry out, administer or enforce a transaction that our client has requested or authorized us to perform; in that connection, we may make such disclosures to:

Our employees or agents who are assisting us in serving our client

At our client's direction or with his or her consent, the client's financial service providers, such as the client's accountant, investment advisor, insurance agent, or the financial institution that our client has designated as trustee of a living trust;

Any person whom we jointly represent with our client. For example, if our client and his spouse have both requested estate planning services from us, we regard our representation of husband and wife as joint and may share information provided by one with the other, unless otherwise agreed;

Any other person or entity to whom our client has authorized our making a disclosure, or to whom disclosure is required by law or applicable rules of procedure.

How Do We Protect the Security & Confidentiality of Client Information?

Within our firm, we retain records relating to our professional services, accessible to our staff, to assist us in effectively representing you and, in some cases, to administer our business or to comply with professional standards. We maintain physical, electronic, and procedural safeguards for your personal non-public information that comply with our professional standards.

If you have further questions regarding the confidentiality of your personal information, please contact any Chetcuti Cauchi lawyer with whom you have worked.

NEWS & ARTICLES /

Navigating malta’s beneficial vat treatment: a comprehensive guide for yacht owners – private and commercial use explained, publication.

22 November 2023

VAT Treatment for Private and Commercial use of Yachts in Malta

Malta has gained a high reputation in the shipping and yachting world, not only because of its geographical location but also because it offers attractive and competitive incentives, thereby making Malta one of the top flags in the world. Malta’s solid roots as a maritime location continue to enhance and expand the island’s footing in the maritime industry.

As well as creating a complete service offering for yachts; from shipyards to berthing facilities, to chandlers to maritime professionals, Malta offers ship and yacht owners several attractive solutions, including attractive VAT incentives for yacht and superyacht owners.

Reduced VAT Rate as from the Start of 2024

As from 1 st January 2024, short term charters commencing in, Malta have benefited from a reduced 12% VAT rate, subject to the fulfilment of certain criteria.

The Tax & Customs Administration’s has released new Guidelines, specifically tailored for the application of the 12% Value Added Tax (VAT) rate pertaining to the rental of pleasure yachts.

The Guidelines can be accessed by clicking this link .

VAT Treatment of Yachts Intended for Private Use

In March 2020, Malta published its guidelines establishing the means by which leased pleasure yachts are to be treated for VAT purposes, with a particular focus on the use and enjoyment provisions on yacht leasing supplies. The Guidelines issued on the subject matter reflect EU developments and practices.

With respect to operating leases, it is possible for a lessor/owner of a yacht to lease out their yacht to a lessee for a consideration, for a specified period of time. Through such a structure, VAT would be payable by the lessee on the monthly lease instalments, depending on the actual use and enjoyment.

In order to benefit from the said VAT treatment, the following conditions must be satisfied:

- The lessor must be a Maltese entity, to be eligible for the Yacht leasing Scheme;

- There must be a yacht leasing agreement in place between the lessor and lessee setting out the conditions of the lease;

- The lessee must be a non-taxable person i.e., not using the yacht for commercial business purposes;

- The yacht must be placed at the disposal of the lessee in Malta;

- The lessor must maintain documentary and/or technological data to determine the actual use and enjoyment of the pleasure boat within and outside EU territorial waters;

This VAT treatment works depending on the ratio of use and enjoyment of the yacht in or outside EU territorial waters.

As a rule, full VAT payment at the rate of 18% is payable when the place of supply of the service is in Malta; however, in cases where the actual effective use and enjoyment of the pleasure yacht would be outside EU waters, there is an adjustment method that would apply.

The result will be that VAT would only be charged on the actual use and enjoyment of the yacht by the lessee in EU territorial waters. To this end, no VAT shall be due on the portion of the lease where the yacht is effectively used and enjoyed outside EU territorial waters.

Therefore, Malta VAT will be applicable solely on the use of the yacht within EU territorial waters; depending on the effective use and enjoyment of the yacht, possibly making it amongst the lowest VAT rates within the EU Member States.

Importantly, the VAT treatment options also provides an element of flexibility when it comes to exiting or terminating the lease. In the eventuality that at the end of the lease the lessor decides to contract the sale of the yacht in Malta, then VAT, at the prevailing standard rate, is charged on the value of the yacht upon subsequent sale.

In such a case should the Maltese VAT Department be satisfied that the necessary rules and regulations have been duly observed, a VAT Paid Certificate would be issued at their sole discretion.

VAT Treatment of Yachts intended for Commercial Use

Yachts intended for commercial use may opt for VAT deferment on the importation as follows:

- Obtaining a VAT deferment on the importation of the commercial yacht by a Maltese owning entity having a Maltese VAT registration; without needing to set up a bank guarantee (as historically required); or

- Obtaining a VAT deferment on the importation of the commercial yacht by an EU owning entity having a Maltese VAT registration, provided that the company duly appoints a VAT representative in Malta, without needing to set up a bank guarantee (as previously required); or

- Obtaining a VAT deferment on the importation of the commercial yacht by a non-EU owning entity, on provision by the importing entity, of a bank guarantee amounting to the VAT payable on 0.75% of the value of the yacht, capped at one million euros.

To opt for the first proposed VAT deferment structure, one would need to incorporate a company in Malta, and this company would need to obtain a valid Malta VAT identification number. In each instance, the importation of the commercial yacht will require the yacht to physically sail to Malta to undergo VAT and Customs procedures.

Following which, the yacht would be imported into the European Union, with the VAT payment deferred accordingly, rather than paid upon importation. In such a case, the yacht would be able to sail freely and circulate within EU waters.

Services Available from Dixcart Malta

At Dixcart Malta we have a dedicated team of professionals dealing with yachting matters including, but not limited to; yacht importation, flag registration, resident agent services, crew payroll. We are also able to assist with a number of your Yachting related needs.

Additional Information

For further information about Malta Maritime services please contact Jonathan Vassallo , at the Dixcart office in Malta: [email protected] .

Related Articles

Isle of Man Superyacht Ownership Structures

Are Malta and Cyprus Shaping the Future of Aviation?

A Guide to the Advantages of Yacht Registration in: Cyprus, Guernsey, Isle of Man, Madeira (Portugal), and Malta

For any enquiries please contact us using our online form:

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-2583253-21 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

- YACHT REGISTRATION

- IMPORTATION AND LEASING OF PLEASURE YACHTS

Andrew Massa

Lead senior associate, kenneth deguara, cfo of df group & head of yachting department, guidelines on reduced 12% vat rate on yacht charters commencing in malta.

In terms of Legal Notice 231 of 2023, which amended the Eighth Schedule of the Maltese VAT Act (Cap 406 of the Laws of Malta), a reduced VAT rate of 12% shall apply to the yacht charters commencing in Malta. On 29 th January 2024, the Malta Tax and Customs Administration issued guidelines for the application of the reduced 12% VAT rate on the chartering of yachts.

This reduced VAT rate applies where the yacht is put at the disposal of the customer in Malta and has come into effect in respect of services which became chargeable for VAT on or after 1 st January 2024.

In order to benefit from the reduced 12% VAT rate, the main requirements are the following:

- A charter agreement is entered into between the lessor and the lessee.

- The agreement is entered into for any term which, when added to the term of previous charter/s by the same lessee within the 12 months preceding the lease, does not exceed 35 days.

- The lessee takes physical possession of the yacht in Malta.

The Guidelines provide a number of hypothetical examples to enable interested parties to determine whether they are eligible to benefit from the reduced 12% VAT rate. These guidelines are accessible through the following link .

Should you require any assistance or advice in connection with the applicability of the Guidelines, please do not hesitate to contact DF Advocates on [email protected] for guidance.

Prada’s Pattern Mark: A fight for Trademark Recognition

A recent decision notably pronounced by the Second Board of Appeal on December 19, 2023, concerned PRADA S.A.’s pattern mark (case R 827/2023-2). Prior to this appeal, the examiner in European Union trademark application No. 18 683 223 initially rejected the disputed pattern trademark due to the observation of a lack of distinctiveness, prompting PRADA…

Survey on the EU Sustainability Disclosure and Reporting Regime

MFSA has today issued a survey with the aim of gauging stakeholders’ level of understanding and preparedness with regards to sustainable finance disclosure and reporting obligations, as well as challenges associated therewith. MFSA is inviting the following stakeholders to participate in such survey by Wednesday 28th February 2024: Completion of the survey is on an…

Tax Commissioner allows accelerated deductions in respect of intellectual property and intellectual property rights

The Commissioner for Tax and Customs in Malta issued a notification, ushering in changes to the rules relating to deductions in respect intellectual property (IP) and intellectual property rights (IPRs). The key modification introduced by this notification involves an acceleration in the timing of deductions for capital expenditures on IP or IPRs and is effective…

In terms of Legal Notice 231 of 2023, which amended the Eighth Schedule of the Maltese VAT Act (Cap 406 of the Laws of Malta), a reduced VAT rate of 12% shall apply to the yacht charters commencing in Malta. On 29th January 2024, the Malta Tax and Customs Administration issued guidelines for the application…

MFSA issues an updated Corporate Governance Manual for Funds

On the 30th October 2023, the Malta Financial Services Authority (‘MFSA’) issued an updated version of the ‘Corporate Governance Manual for Directors of Collective Investment Schemes’. The Manual is complementary to the new ‘Corporate Governance Code’ published by the MFSA in August 2022, and focuses on the principles that should be followed by directors of…

Reduced VAT rate for short-term yacht charters

The yachting industry in Malta is an ever-growing sector. At present, there are over 1,000 yachts above 24 metres in length registered under the Malta flag. Several yachting companies have opted to establish themselves in Malta due to the various benefits that may be enjoyed as well as the facilities available on the island. As…

MFSA Announces Consultation on Changes to Chapter 3 of the Virtual Financial Assets Rulebook

The Malta Financial Services Authority (‘MFSA’) has, on the 18 September 2023, issued a draft version of the updated Chapter 3 of the Virtual Financial Assets Rulebook for consultation (the ‘Consultation Document’). The Consultation Document aims to align the VFA Framework following the entry into force of the Markets in Crypto- Assets Regulation (‘MiCAR’) in…

Malta Enterprise Announces Financial Assistance for ESG Reporting

The Minister for the Environment together with the Malta Enterprise CEO have announced a new ESG Grant intended to help support small and medium sized businesses (SMEs) in enhancing their sustainability and further push them to be more environmentally conscious. The Grant aims at providing financial assistance to an extensive list of businesses which will…

Landmark Judgement: DF Advocates successfully assists client with obtaining recognition of names assumed after contracting marriage in a foreign jurisdiction – the court orders the public registry to update its records and procedures.

L-Avukat Dr. Marlon Borg bħala mandatarju speċjali tal-assenti Michael Debono Mrden vs. Direttur tar-Reġistru Pubbliku (452/21/1 JVC) Court of Appeal (Superior Jurisdiction) 12th July 2023 Overview On the 12th of July 2023, the Court of Appeal in its Superior Jurisdiction (“COA”) overturned a judgment delivered from the First Hall Civil Court (“FHCC”) whereby the COA…

FIAU publishes its 2023-2024 AML/CFT Supervisory Plan

On the 25th July 2023, the FIAU published its supervisory priorities for the year 2023-2024. In determining the said plan, the FIAU has adopted a risk-based approached which was based on the information submitted annually by subject persons through the submission of an “Annual Risk Evaluation Questionnaire” along with data obtained from other sources such…

We use cookies to personalise content, provide social media features, and analyse traffic. To disable cookies, this can be configured via the web browser. However this can limit your experience with our website.

Tax Professional usually responds in minutes

Our tax advisers are all verified

Unlimited follow-up questions

- Ask a question

ARTICLE - Malta

Special 12% VAT Rate for Yacht Charters in Malta

Special 12% vat rate for yacht charters in malta - introduction, guidelines and regulatory framework, conditions for vat rate eligibility.

- The yacht must be available for charter in Malta at the commencement of the charter period.

- The charter must be under a specific charter party agreement for a set term.

- The total charter duration for the specified yacht (or similar types) must not exceed 35 days within the preceding 12 months from the start of the current charter.

Composite Supply and VAT Application

Special 12% vat rate for yacht charters in malta - conclusion, final thoughts, related to this article, italy flat tax regime – cost of entry doubles, taxpayer wins ireland’s first transfer pricing case, tax cuts for corporations and individuals for luxembourg, lorem ipsum dolor sit amet, consectetur adipiscing elit. vivamus ut semper risus. fusce ac pharetra sem. praesent vitae eros a quam fermentum dignissim..

MR BLAKEFIELD. REGAL CAPITAL. FLORIDA.

If you’re having any problems with your membership, account, or just generally loving Tax Natives. Drop us a line here and we’ll get back to you.

Malta Yachting VAT

In order to understand the application of the Malta VAT on yachts, let us see the general legal framework, the step-by-step checklist and a practical example.

VAT Treatment of Malta Yachts: Legal Basis

Malta yacht VAT regime is regulated by national and EU legislation, namely:

- VAT Act (Cap. 406)

- Council Directive 2006/112/EC

- Council Implementing Regulation 282/2011ECJ case law

Malta Yachting VAT: Checklist

By going through the questions below, you will be able to eventually define the yachting VAT treatment in a particular scenario:

1. Who is carrying out the transaction and for whom?

| any person who, independently, carries out in any place, any economic activity, whatever the purpose or results of that activity | any person who is not a taxable person | any person, other than a physical person who is not a taxable person |

2. What is the nature of the operation?

| Transfer | Hiring of a means of transport |

| Intra-Community acquisition | Passenger transport |

| Importation | Management or operating |

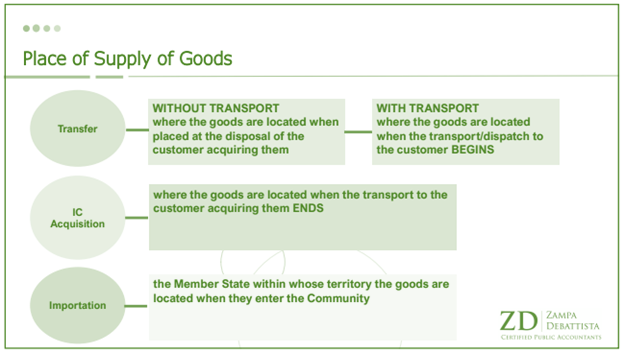

3. What is the place of supply?

The place of supply is the tax jurisdiction where a particular yachting transaction falls to be taxed on the basis of the nature of the supply and the tax status of each of the parties involved.

Not sure what is the place of supply in your case? GET IN TOUCH

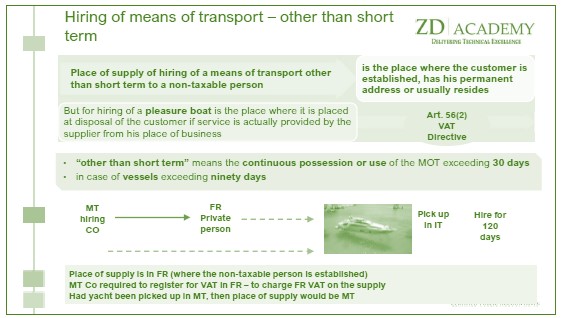

Specific place of supply rules for hiring (chartering) of yachts:

4. Does any exemption apply?

There are the following VAT exemptions for yacht supplies made in Malta:

- supply of (qualifying) sea vessels;

- supply of equipment incorporated or used therein (to constructors, owners or operators only);

- services of modification, maintenance, chartering and hiring or equipment referred to the above point;

- services for the direct needs of the sea vessels; for the direct needs of their cargo; assistance to passengers or crew for the account of the shipowners.

The use and enjoyment clause as applied in Malta

Malta applies the use and enjoyment provision of the VAT Directive (Art. 59a) whereby, under certain terms and conditions, where a pleasure boat is chartered long-term the actual use and enjoyment of the pleasure boat outside EU territorial waters is treated as VAT exempt.

Malta Yacht Leasing

The beneficial VAT yacht leasing regime in Malta stands for a long-term charter of a pleasure boat, whereby the VAT incurred on the purchase of the pleasure boat will be deducted immediately and then paid with the lease instalments over the period of the long-term lease.

Do you want to learn more about each of the exemptions and check whether you qualify? GET IN TOUCH

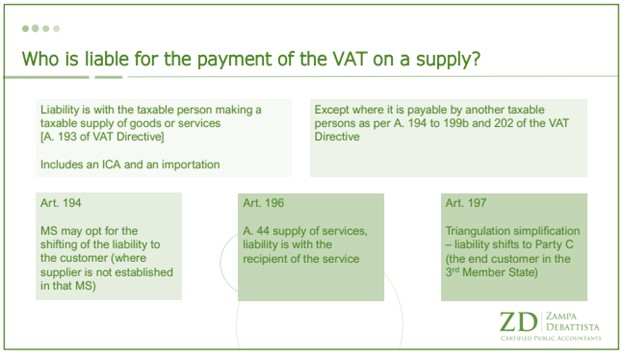

5. Who is liable to pay Malta VAT on Yachts?

Are you struggling to define who is taxable and to which extent? GET IN TOUCH

Malta VAT on Yachts: Practical Case Study

Vat scenario:.

Sunwater Ltd. is a company established in Malta. It is the go to company for chartering of vessels. In certain instances it acquires vessels itself from Italy which it charters for less than 40 days to private individuals. It parks its vessels in Marinas in Italy, Monaco and Malta. Its customers are business owners who are in the business of chartering. They charter in and then charter out vessels to private consumers. Sunwater would like to understand the VAT implications of all its purchases and sales transactions.

VAT analysis (purchases):

| B2B | |

| Intra-Community acquisition | |

| Where the transport ends Malta, Italy France | |

| N/A unless the supplier knows exactly that the vessel will be chartered to a business who will use it for navigation purposes on the high seas | |

| In terms of A200, the person making the acquisition |

VAT analysis (sales):

| B2B | B2C | |

| Short-term chartering of vessels | Short-term chartering of vessels | |

| Malta, Italy, France | Malta, Italy, France | |

| If in Malta, possibly if it meets the condition of the exemption | N/A | |

| Supplier, unless A194 applies in MS of the customer in which case liability is shifted on the customer | Supplier |

ENTRUST YOUR VAT MATTERS TO US

Previous Post Black Friday – Revenue Accounting for Discounts and Incentives

Next post ten things you may not know about gapsme.

Comments are closed.

- Student Hub

- Audit & Assurance

- Corporate Services

- Digital Consulting

- Financial Reporting

- Internal Audit

Quick Links

- Get in touch

- Privacy Policy

© 2024 Zampa Debattista.

crafted by BRND WGN

- History & Values

- ESG & Sustainability

- Meet the Team

- Engagements

- Engagement Quality

- ACCA Programme

- University Programme

- Internship Programme

Consumer and Retail

Energy and Utilities

Financial Services

Health Care and Pharmaceutical

Private Client

Real Estate, Construction and Infrastructure

Technology, Media and Telecommunications (TMT)

Transport and International Trade

PRACTICE AREAS

Aviation Law

Banking & Finance

Commercial Law

Competition Law

Conveyancing and Leasing

Corporate Law

Development & Planning Permissions

Environmental Law

ESG & Sustainability

Immigration

Insurance and Pensions

Intellectual Property

Investment Services and Funds

Litigation and Dispute Resolution

Public Procurement

Private Wealth

Marine Litigation

Mergers & Acquisitions

Pharmaceuticals

Privacy and Data Protection

Ship Finance

Ship Registration

Technology and Telecomms

Trusts and Foundations

Insight Types

Publications, search anything, special 12% vat rate for yacht charters commencing in malta.

Alison Vassallo

Reading time, practice area.

The most notable local development from a VAT /tax perspective in the realm of superyachts is undoubtedly the introduction of a special 12% VAT rate on charters commencing in Malta. This was introduced by the Malta tax authorities by virtue of Legal Notice 231 of 2023 titled the Value Added Tax Act (Amendment of Eight Schedule) Regulations, 2023 with effect from 1st January of this year. Subject to a number of conditions, charters will be able to benefit from a special 12% rate which is therefore lower than the standard 18% Malta VAT rate.

The Malta tax department also published guidelines to accompany the Legal Notice to better assist the industry in the application and interpretation of these Regulations.

These were also followed by the recent publication of a Port Notice by Transport Malta, which clarifies that visiting yachts calling at Malta for the purpose of commencing a charter operation and/or for berthing/mooring purposes and/or to receive a service but whose normal course of operations and navigation is outside Maltese territorial waters, are exempt from complying with the provisions of the Commercial Vessels Regulations. However, such yachts must provide a copy of the registration document indicating the commercial status of the yacht and if applicable a valid licence or permit to operate commercially as may be required by their flag state.

Conditions for the application of the special VAT rate:

- The main conditions for a yacht charter to qualify for the reduced 12% VAT rate are as follows:

- The place of hiring e. the place where the yacht is put at the disposal of the charterer, must be in Malta.

- The charter must be conducted in accordance with a charterparty agreement concluded for a specified term.

The total charter period with respect to a particular yacht or yachts of the same kind does not exceed 5 weeks (35 days) during the previous twelve (12) months ending on the date of the beginning of the existing charter period.

The Guidelines also clarify that where a taxable person provides mixed supplies, consisting of goods and services which are subject to different VAT treatment, such supplies may constitute a single composite supply for VAT purposes. In that case, the applicable VAT treatment for such a single composite supply is the same VAT treatment applicable to the principal component of that supply. In this case therefore the principal component would be the charter which, subject to the above conditions, may be subject to the 12% special VAT rate. In light of this, the Guidelines clarify that supplies which may benefit from the 12% VAT rate are those supplies which are typically made available during the course of a charter. Supplies which are provided upon specific request of the charterer, or goods which are not of a consumable nature, or goods which are not available upon placing the yacht at the disposal of the charterer would not deemed to form part of a single composite supply and cannot benefit from the 12% VAT rate.

Related Insights

Alison Vassallo writes in Barche Magazine about the Malta 12% Yacht Charter Rate

Issuance of the Small Commercial Yacht Code (sCYC) 2024

Port Notice on the Hiring of a Pleasure Boat

Alison Vassallo Shares Insights with Malta Invest 2024

Alison Vassallo writes in The Malta Chamber’s Movers and Shakers 2023

View all insights.

VAT on Maltese Registered Pleasure Yachts

The Maltese legislation offers third parties the ability to become the owners of an EU VAT-paid yacht with an effective VAT rate of 6.12%, excluding tax and cost transactions which give a risen outlay of 8%. The VAT treatment guidelines on yacht leasing published in 2019, offer parties the ability to deduct any input VAT incurred on the purchase of the yacht through a lease agreement between the owning company, a company registered under the laws of Malta that primarily acquires the yacht, and the lessee. This has to be executed in adherence to the provisos listed in the regulation and briefly listed below.

.jpg)

The yacht can be purchased both as new as well as second hand, and may be purchased from an EU supplier or a Non-EU supplier as the beneficial owner deems fit. Upon registration of the yacht in Malta, it is imposed that the vessel is brought and berthed in Malta and that the prior approval from the Director General VAT is acquired. Furthermore, following the revision of the regulations, the VAT portion is no longer paid in proportion to the size of the yacht, but is to be paid in full at the standard rate of 18%, which in turn is claimed back by the lessor through the trimester VAT return. The VAT paid certificate is then issued. Throughout the lease, a log is to be maintained by the lessee throughout the use of the pleasure craft, whereby the percentage use of the pleasure craft in EU and non-EU territorial waters is determined. In this regard, the lessor can determine the portion of the lease that is taxable at the 18% rate as well as the portion that is not subject to tax due to the effective enjoyment being outside EU waters.

For understanding purposes, the following is a worked out case study of an individual who purchased a yacht from a an Italian supplier. The individual sets up a company in Malta which acquires a 25-metre yacht with a value of €1,000,000. The yacht is brought to Malta and berthed. The full 18% VAT, i.e. €18,000, are paid upon registration, which are then fully claimed back in the company's trimester VAT return under Article 2 of the VAT Act. In this regard, the VAT paid at a company level (lessor) will be that of 0%, as the yacht is bought as a capital good. The company then leases the yacht to the individual subject to the above-mentioned requirements, on a 36-month basis contract, at a lease of 10% of the value of the yacht i.e. that of €100,000 over a period of 36 months. During the period of the lease, the lessor gathers data from reasonable documentation, of the yacht's effective use of enjoyment, and charges VAT on the lease depending on the preliminary ratio established of the effective enjoyment of the pleasure craft in EU territorial waters, i.e. if the yacht is 60% of the time outside EU waters, and the lease is that of €2,778 per month, only €1.111 are taxed at 18% VAT. The rest are non-taxable. The details on the preliminary ratios and method statement are further explained in this link . Further to the above VAT implications and computation, the lessor is charged tax only on the annual financing charging, which in turn is allowed a deduction against this income through expenses relating to repairs, maintenance and insurances attributable to the yacht. Additionally, the lessee is allowed capital allowances in respect of the yacht and may opt to shift the burden of such allowances onto the lessor, subject to written agreement between the parties listed in the contract. Where the lessee exercises the option to purchase the yacht, the financial consideration received by the lessor is deemed of a capital nature and therefore no tax thereon shall be paid. Moreover, the owner of the Malta Company is eligible to further tax benefits , including an effective corporate tax rate of 5% on the distribution of dividends.

The procedure for the above is relatively facilitated and cost-effective with the steps being mainly as follows:

Incorporation of a Malta Company

Purchase of Yacht

Yacht Registration

Lease of the Vessel

Discover all the advantageous of registering and berthing your yacht in the Maltese Islands through our array of professional and timely services. Contact us to set-up an appointment and we will guide you through owning your dream yacht.

International

Andersen global, recognition, families & wealth, immigration, yachts, jets & art, financial services, technologies, top 3 reasons to register your yacht in malta.

When registering your yacht in Malta, you will benefit from VAT minimisation and tax planning down to potentially 5.4%, the reputability of the Malta flag.

While cruising the Mediterranean Sea and visiting picturesque little villages along foreign costs is probably the dream of all yacht lovers , a seasoned yacht owner or seller will probably tell you that there is more to owning a yacht than what meets the eye. The next step after acquiring your yacht is to register the vessel under the flag of a jurisdiction of your choice. As a yacht owner, it is in your best interest to choose a jurisdiction which is fiscally competitive and highly accessible, yet still reputable.

Malta is a tiny member state in the middle of the Mediterranean Sea. It comes as no surprise that its strategic geographic location has helped it immensely in leaving a footprint in the maritime history of the Mediterranean . However, its success as the largest ship and yacht registrar in Europe and the 6 th largest registry in the world can be attributed to more than just its location.

So, how did such a small island manage to become one of the top jurisdictions in the world to register vessels, particularly superyachts ? Let’s break the benefits down into three easy steps:

1. Reduce your VAT liability down to potentially 5.4%

VAT requirements are nothing short of a headache for European Yacht owners as well as those sailing in EU waters. Pleasure Yachts which spend more than 6 months in any calendar year cruising in the EU or which are purchased or owned by EU residents or imported into the EU are subject to the EU’s VAT.

While all vessels sailing in the EU are subject to VAT, by registering your yacht in Malta you could potentially reduce your VAT liability down to 5.4% through a leasing set up for yachts over 24 metres. Malta has become the European Ship registry of choice for brokers and sellers as well as yacht owners seeking to register pleasure and super yachts because it provides the possibility of tax planning.

The effective VAT tax rate will depend on the length and type of vessel (whether sailing or motor), and are charged as follows

- Sailing boats or motor boats over 24 metres in length - 5.4%

- Sailing boats between 20.01 to 24 metres in length - 7.2%

- Motor boats between 16.01 to 24 metres in length - 7.2%

- Sailing boats between 10.01 to 20 metres in length - 9%

- Motor boats between 12.01 to 16 metres in length - 9%

- Sailing boats up to 10 metres in length - 10.8%

- Motor boats between 7.51 to 12 metres in length (if registered in the commercial register) - 10.8%

- Motor yachts up to 7.51 metres in length (if registered in the commercial register) – 16.2%

As regards VAT payable on the purchase of the yacht by the company, the leasing of the yacht is a determining factor. The lessor company uses the yacht for its economic activity, which in return grants the lessor company the right to deduct any input VAT incurred on the purchase of the yacht.

As regards the VAT charged by the company in relation to the leasing fees, the rate of VAT payable is commensurate to a percentage reflecting the use of the yacht in EU waters. Such percentage is set in accordance with the length and type of yacht (whether motor or sailing) resulting in an effective rate of VAT payable ranging from the full 18%, being the rate of VAT generally payable in Malta, to other different rates down to 5.4% for yachts over 24 meters.

2. Reputability of its Flag and Register

While there are other jurisdictions which come off as cheaper options, registering your yacht under a reputable flag is essential if you want to sail in EU waters with peace of mind. Reputability is a sine qua non factor in the maritime industry, thus, Dr Silvana Zammit, head of the Maritime Law practice at Chetcuti Cauchi Advocates emphasises the importance of choosing a reputable flag that has been listed on the white list of the Paris MoU. The Maltese Flag is the most popular EU flag amongst superyachts registered in the EU because Malta has entered into a number of treaties aimed at regulating and supervising the industry which has earned it a position on the White list on both the Paris MOU as well as the Tokyo MOU, and it has also entered into various bilateral agreements with foreign governments where Maltese ships receive preferential treatment in respect of port charges and taxes . Malta also carries out a highly rigorous supervisory exercise on vessels registered under its flag. It has set up a Flag state inspectorate which ensures adherence to international standards which adds to the reputability of the Malta flag.

3. Quick Straightforward Procedure

Although Malta imposes rigorous standards that have earned it such a golden reputation in the maritime sphere, these standards do not hinder those seeking to register their vessel. Malta provides for a straightforward procedure for registration and deletion of vessels, including the registration and discharging of mortgages which are essential when seeking to obtain financing.

In fact, there are a number of benefits associated with registering in Malta, including:

- its competitive registration and renewal fees;

- no restrictions on the nationality of the master, officers and crew serving on Maltese vessels;

- minimum technical requirements in relation to pleasure yachts allowing owners to freely design their own yachts;

- a 24-hour service to deal with urgent matters.

From a tax perspective, the procedure to benefit from the reduced effective VAT rates mentioned above is highly straightforward, particularly when you are assisted by a team of experienced maritime lawyers.

How does the Malta solution work?

In just a few straightforward steps, Malta has created a system whereby ownership of the yacht can pass onto the buyer at a reduced VAT rate. The procedure is relatively simple. While the buyer will still have full access to use and enjoy the yacht, he or she will initially start doing so under a leasing set up. The leasing set up involves the creation of a Malta company with the ultimate aim of passing on ownership of the yacht to the buyer.

- Prior to registering the yacht, the latter must be brought to Malta.

- A Maltese company will be set up which will acquire the yacht.

- After the yacht has been registered under the Malta flag, the company can lease the yacht to the buyer who will carry out the sale of the yacht at the end of the lease.

- At the beginning of the lease, an initial contribution, hence the first lease payment must be made, which must amount to 40% of the value of the vessel by the lessee (the prospective buyer) to the lessor company.

- The remaining portion must be paid in lease instalments which are payable every month through an agreement which does not exceed 36 months.

- At the end of the lease, the sale of the yacht is carried out for at least 1% of the purchase value on the return of the yacht to Malta at the expiration of the lease

- Subject to all the relative VAT payments, the issuing of a VAT paid certificate in relation to the yacht by the authorities, following which the yacht may circulate freely in the EU.

Fill in the form below to get a free consultation from Dr Silvana Zammit, our maritime law expert who will be able to show you how you can benefit from the Malta VAT yacht solution.

See all Publications

Share this article on, related publications.

AI and Maritime Law

Related content, related practice groups, related practices, related services, malta pleasure yacht registration, related products, malta commercial yacht registrations, malta yacht ownership structures, malta yacht structures, related opportunities, related insights, pleasure yachts new malta place of supply guidelines out, work on malta superyacht policy 2022 announced, related factsheets, benefit from a recognised expert.

Guidelines On Reduced 12% VAT Rate On Yacht Charters Commencing In Malta

Contributor.

In terms of Legal Notice 231 of 2023, which amended the Eighth Schedule of the Maltese VAT Act (Cap 406 of the Laws of Malta), a reduced VAT rate of 12% shall apply to the yacht charters commencing in Malta. On 29 th January 2024, the Malta Tax and Customs Administration issued guidelines for the application of the reduced 12% VAT rate on the chartering of yachts.

This reduced VAT rate applies where the yacht is put at the disposal of the customer in Malta and has come into effect in respect of services which became chargeable for VAT on or after 1 st January 2024.

In order to benefit from the reduced 12% VAT rate, the main requirements are the following:

- A charter agreement is entered into between the lessor and the lessee.

- The agreement is entered into for any term which, when added to the term of previous charter/s by the same lessee within the 12 months preceding the lease, does not exceed 35 days.

- The lessee takes physical possession of the yacht in Malta.

The Guidelines provide a number of hypothetical examples to enable interested parties to determine whether they are eligible to benefit from the reduced 12% VAT rate. These guidelines are accessible through the following link .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Mondaq uses cookies on this website. By using our website you agree to our use of cookies as set out in our Privacy Policy.

- PUBLICATIONS

- PARTNERSHIP

Tonnage Tax services in Malta

Maltese law requires the payment of an annual tonnage tax by all Malta-registered vessels. Upon payment of such tonnage tax, the annual certificate of registration is issued for the vessel in question and valid for a full year therefrom.

Our firm can assist in dealing with Transport Malta and handling the calculation and payment of any such tonnage tax, together with filing the necessary documents to keep any Malta-registered vessel in good standing, including commercially registered vessels.

Shipping operations for the corporate entities established in Malta are subject to the annual tax, which consists from registration fees and annual tonnage tax.

The rate of the tonnage tax depends on the age of the ship and is being reduced respectively.

For that reason all vessels are divided into two categories:

⚓ Non – tonnage tax ships:

- small pleasure yachts less than 24 metres length;

- commercial yachts more than 24 metres in length and less than 500 gross tonnes.

⚓ Tonnage tax ships – ships of more than 24 metres in length and 500 gross tonnes and over.

Those charges are being reduced for the ships from 0 to 5 and from 5 to 10 year age categories respectively. Charges are subject to increase for age from 15 to 30 year and over.

Taxation System for shipping activity.

Shipping companies, which are incorporated to operate in Malta, are exempt from income tax .

To apply for this scheme the shipping company has to be registered in the Malta Business Registry including the name and tonnage of the vessel to be owned or operating.

The requirement is the vessel has to be declared as Tonnage Tax ship to be owned, managed, operated, chartered etc. by the establishing shipping organization.

The minimum tonnage for those vessels is 1,000 gross tonnes.

Changes in 2018 to the taxation of shipping activities has extended to commercial chartering the tonnage tax exemption and has also to, within certain parameters, entities registered within the European Union that fly a Maltese flag and are carrying out commercial activities.

Registration fees paid to Malta Transport:

Registration fees/Tonnage tax (see Schedule of fees below) – is being paid one time, when register a ship , and then annually to get certificate extended.

Schedule of Fees

Information from the web page of Malta Transport:

https://www.transport.gov.mt/Registration-Fees-and-Tonnage-Tax.pdf-f2829

Registration fees and tonnage tax.

Ai. The fee on registration and the annual fee for non-tonnage tax ships.

Aii. The fee on registration and the annual fee for tonnage tax ships.

Subject to the provisions of article 7(4) of this Act, when there is a change in the particulars or category of a registered ship and the new applicable fee or tonnage tax payable on registration or annually is higher than that already payable, the provisions of article 19(7) of this Act in respect of laid up vessels shall mutatis mutandis apply.

B. The rates per net tonnage payable on registration, annual register fee and annual tonnage tax when referred to in paragraph A.i and A.ii.

C. Reduction or increase on the rates per net tonnage on registration, register fee and tonnage tax, when referred to in paragraph A.i or A.ii.

Annual fees for any one year paid after the anniversary of registration for that year shall be increased by ten per cent. Pre-registration inspections are subject to a charge provided for in Merchant Shipping Notice 127 Rev 1. The unit of currency is the Euro.

The Benefits of yacht registration in Malta

— Malta Yacht Registration Process

— Tax Benefits

— Temporary Importation

— VAT Leasing Malta

Get Support From Our Specialised Professionals:

We provide full array of maritime services:

- Advisory services to individuals and legal entities who wish to register yachts under the Malta Flag.

- Services on the adoption of efficient tax structures at maximising the particular needs of the yacht owner.

- We may act as a resident agent for the registration of a company in Malta to act as owner of the yacht and liaise with certified surveyors as well as the shipping Directorate of Transport Malta in order to have the provisional / permanent registration.

- Corporate Services Malta

- Malta Company Registration

- Tax in Malta

- Business Outsourcing

- Accounting Services (CPA)

- Audit, Assurance and Reporting

- Trusts, Foundations, Associations

- Funds, Investments and Regulated Financial Services

- Maritime – Malta flag

- Immigration – Malta Residence

Our company’s mission – to provide quality financial services to our esteemed local and international clients, keeping their needs at the centre of our ethos; going the extra mile to efficiently and effectively assist them in growing and fulfilling their business and personal needs.

Need professional assistance? Get in touch to see how we can help you!

KPMG Personalisation

Yacht Importation Procedures in Malta Yacht Importation Procedures in Malta

New importation procedures relating to commercial yachts.

- Home ›

- Industries ›

- Shipping and Yachting ›

- Malta the Jurisdiction of choice for Yachts ›

- Yacht Importation Procedures in Malta

Malta recently revamped its rules concerning the importation of yachts used for commercial purpose

In principle, the importation of a yacht in Malta is subject to 18% Maltese VAT, payable to the Customs Authorities at point of customs clearance.

When the yacht is imported for non-business purpose, the 18% import VAT would not be reclaimable.

Conversely when the yacht is intended to be leased out or used commercially (“Commercial Yacht”), the import VAT can be claimed back by the importer through standard VAT claim procedures.

However, Malta applies attractive VAT deferment procedures for Commercial Yachts which replace the need to physically pay and eventually recover the VAT i.e. which give a substantial cashflow advantage to the importer. These procedures have recently become less onerous. Subject to the satisfaction of certain conditions, VAT-registered importers of Commercial Yachts may procure an authorisation for such VAT to be deferred, even without the need of a bank guarantee in cases when the Revenue Authorities can easily follow the activities of the person importing the yacht. In other instances, the most that the Revenue Authorities would require is either a bank guarantee of 0.75% of the yacht’s value, capped at EUR1 million or the appointment of a VAT representative in terms of Maltese VAT law.

As an alternative to the commercial importation of a yacht in Malta one could also avail from the Temporary Importation or Temporary Admission.

Temporary Importation / Temporary Admission is open to owners of yachts not resident in the EU who plan to use the yacht temporarily in the territory of the European Union. Such Temporary Importation / Temporary Admission procedure can be done via Malta, in which case, the yacht in question would have to enter the European Union through Malta. Certain Customs formalities would need to be adhered to. Under Temporary Importation / Temporary Admission procedure, the yacht would be able to sail freely within the territory of the European Union for a maximum period of 18 months.

For more information about importation procedures and formalities in Malta feel free to contact Anthony Pace .

Anthony Pace

Partner, Head of Tax

KPMG in Malta

Email [email protected]

Connect with us

- Find office locations kpmg.findOfficeLocations

- Email us kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Malta the Jurisdiction of choice for Yacht Owners and Charterers

The Yachting Sector represents one of the main pillars of the Shipping economy in Malta.

VAT Treatment of Yacht Leasing

VAT Department issues new 2020 Guidelines on Yacht Leasing.

Want the latest KPMG {tag_name} content?

Register now and set up your personalised dashboard around {tag_name} and all the other topics that interest you.

- Fuq il-Baħar, Moħħok Hemm 2022

- Safety of Navigation

- Yachting in Malta

- Main Port Charges

- Maritime Statistics

- Notice to Boat users

- Other Ports

- Primary Berthing Facilities

- Port of Marsaxlokk

- Port of Valletta

- EU Projects

- Western Mediterranean Region Marine Oil and HNS Pollution Cooperation

- Environmental Regulations

- Local Waters- How to dispose waste

- Recognised Security Organisations (RSO's)

- National Port Security and local waters

- Maritime Security Flag State

- List of Training Facilities

- LNG as a marine fuel in Malta

- Passenger Ship Safety Guidelines

- Marsaxlokk and Mgarr (Gozo) Tides Gauge

- Recent - Official Notices

- Archive - Port Notices

- Archive - Local Notices to Mariners

- Archive - Coastal Notices to Mariners

- Notices of Wrecks, Abandoned and Derelict Vessels

- Mooring Notices

- Warrants of Arrest

- Vessel Traffic Services

- Pilotage Procedure

- Ferry Service Grand Harbour - Mgarr Gozo

- Ferry Service Grand Harbour & Marsamxett

- Barrakka Lift

- Request for ABEYANCE (Temporary Closure)

- Registering a Small Ship

- New Registration

- Registration of Boats Previously Registered on Another Register

- Registration of Boats Being Imported by Purchaser

- Registration of a self-built small ship for own personal use

- Re-Registration (boat previously registered with the Small Ships Register)

- Renewal of Registration of Small Ships

- Transfer of ownership of a Small Ship

- Voluntary Termination of Registration of a Small Ship

- Application by an Authorised Boat Dealer for the suspension of the re-Registration of a Small Ship registered in his/her name

- Declaration re Lost Official Document

- Exam Applications

- Merchant Shipping

- Registration Process

- Bareboat Charter Registration

- Authorised Recognised Organisations

- Closure of Registry

- Guidelines - Transfer of Ownership

- Legislation

- MLC 2006 & STCW

- Seafarer Portal

- Ships Under Construction

- Introduction

- Why choose the Malta Flag

- Vision and Mission

- Registration Procedure

- List of Appointed Ship Surveyors

- Manning and Certification of Crew

- New Buildings

- Small Commercial Yacht Code

- Commercial Yacht Code

- Commercial Yachting Notices

- Passenger Yacht Code

- Technical Notices

- Information Notices

Useful links:

- Ship Registration Fees Calculator

- Registration Fees and tonnage tax

- Taiwan News

- Editorial & Opinion

- Bilingual Pages

- All Front Page Taiwan News Business Editorial & Opinion Sports World News Features Bilingual Pages

Sun, Aug 18, 2024 page1

Living expense tax allowance might increase, shift: the disposable income gap between the top and bottom 20% is the smallest it has been since 2019 and dropped for the first time in seven years.

- Staff writer, with CNA

The annual tax-deductible allowance for basic living expenses could be raised to NT$209,000 (US$6,473) per person next year, the Directorate-General of Budget, Accounting and Statistics (DGBAS) said on Friday.

In its Survey of Family Income and Expenditure for last year, median disposable income per capita was NT$349,000, up 3.7 percent from the previous reporting year, the DGBAS said.

Based on that figure, the tax-deductible allowance for basic living expenses per person should be about NT$209,000 for this year’s income tax purposes, a NT$7,000 increase from NT$202,000 for last year, the statistics agency said.

The Ministry of Finance logo is displayed on its main building in Taipei in an undated photograph.

Photo: Clare Cheng, Taipei Times

Under the Taxpayer Rights Protection Act (納稅者權利保護法), the government is prevented from taxing the amount people need to purchase basic necessities, which is set at 60 percent of the median per capita disposable income from the preceding year.

The Ministry of Finance said the exact figure for the adjusted tax deductible allowance for basic living expenses would officially be announced at the end of this year.

Under the tax system, if the basic living expenses allowance exceeds the combined personal exemption, the standard deduction and special deductions, the difference can be deducted from gross income.

This allowance is generally used by households in which there are children, because for single people and couples without dependents, the basic exemption and standard deduction is usually more favorable, totaling NT$216,000 per person for the 2023 fiscal year.

However, exemptions per dependent for last year were NT$92,000 per person in most cases, while the basic living expense allowance can be claimed for each person in a tax return, including dependents.

Meanwhile, the gap in disposable income between the top and bottom 20 percent of income earners in Taiwan is the narrowest it has been since 2019, the Survey of Family Income and Expenditure showed.

Average disposable income per household last year was NT$1.137 million, up 2.5 percent from 2022, and average disposable income per capita was NT$407,000, up 4 percent from a year earlier, the survey showed.

Average disposable income per household for the top 20 percent of income earners increased 2.6 percent from 2022 to NT$2.302 million, while for the bottom 20 percent it rose 3 percent to NT$376,000, it showed.

That means the income of the top 20 percent was 6.12 times higher than that of the bottom 20 percent, lower than 6.15 in 2022 and the lowest since 6.1 in 2019, the DGBAS said.

It was also the first time the ratio has declined year-on-year since 2017.

Most Popular

China to release four fishing boat crewmen today, toxic substances found in shein and temu products, china appears to have used a new type of drone, china fans include taiwan and hk in olympic success, fewer foreigners studying in taiwan universities: report.

You might also like

SEASONAL MORATORIUM: The boat was boarded and seized by the China Coast Guard east-northeast of Liaoluo Bay outside restricted waters on July 2 Four crew members of a Taiwanese fishing vessel detained by Chinese authorities since July 2 are expected to be released today, but the return dates of the captain and the boat remain uncertain, a former official said. The Fujian Provincial People’s Government’s Taiwan Affairs Office (TAO) is likely to first release the crew members today, including a Taiwanese surnamed Ting (丁) and three Indonesians, former Penghu County Council deputy speaker Chen Shuang-chuan (陳雙全) said yesterday. They are to take a boat to the median line of the Taiwan Strait, where they would be picked up by the Da Jin Man No. 96

China appears to be using a new type of BZK-005 drone that might be capable of disrupting the radio communications in the Taiwanese military and causing the radar system to malfunction, a military source said yesterday. The military is closely monitoring traces of this upgraded drone after the Japanese Ministry of Defense recently captured images of a BZK-005 drone, which had a large number of antennas under the nose of the aircraft and a pod of unknown purpose attached under the belly of the craft. Defense experts in other countries had warned that the Chinese People’s Liberation Army (PLA) has bolstered

By Lo Tien-ping and Shelley Shan

Lin the pride of Taiwan, president says

CHAMPION: Lin Yu-ting overcame adversity and intense international scrutiny on her path to Olympic victory. She said it means so much to win the gold for her country Taiwanese boxer Lin Yu-ting (林郁婷) emerged as Olympic champion in the women’s 57kg (featherweight) division on Saturday in Paris (Sunday in Taipei), despite facing online abuse due to gender misconceptions over the past two weeks. Lin defeated Julia Szeremeta of Poland by a unanimous 5-0 decision to clinch the gold, completing a long journey of redemption after being eliminated from the Tokyo Games in 2021 in her opening bout. Lin, who has been competing in women’s events since her boxing debut in September 2013, is the first Taiwanese boxer to win gold, after three other Taiwanese female boxers earned bronze medals in

Team Taiwan totals two golds and five bronzes

Taiwanese boxer Lin Yu-ting (林郁婷) won a gold medal in the women’s featherweight division at the Olympics on Saturday in Paris, boosting Team Taiwan’s medal count to two golds and five bronzes. The medal count is the third time Taiwan has won two golds in a single edition of the Olympic Games. Lin, 28, clinched the gold in the women’s 57kg boxing division after defeating Julia Szeremeta of Poland by a 5-0 unanimous decision, completing a long journey to success after she was eliminated from the Tokyo Games three years ago in her opening bout. Taiwan’s other gold in Paris was bagged by

IMAGES

COMMENTS

The importation of a yacht, intended for commercial use, into Malta is subject to the standard rate of 18% VAT. However, there is a VAT deferment scheme available which replaces the need to physically pay over the 18% VAT to the tax authorities. A bank guarantee is required in this case and the guarantee must be the equivalent of 20% of the VAT ...

Malta VAT on Yachts can be reduced through a leasing-scheme. This page also includes an overview of the effective rates on Malta VAT on Yachts. The EU Value Added Tax (VAT) is a form of consumption tax system which applies all throughout all the member states of the European Union.

As well as creating a complete service offering for yachts; from shipyards to berthing facilities, to chandlers to maritime professionals, Malta offers ship and yacht owners several attractive solutions, including attractive VAT incentives for yacht and superyacht owners.

Guidelines on reduced 12% VAT Rate on yacht charters commencing in Malta In terms of Legal Notice 231 of 2023, which amended the Eighth Schedule of the Maltese VAT Act (Cap 406 of the Laws of Malta), a reduced VAT rate of 12% shall apply to the yacht charters commencing in Malta. On 29 th January 2024, the Malta Tax and Customs Administration issued guidelines for the application of the ...

Malta has introduced a special 12% VAT rate for yacht charters commencing in the region as of January 1, 2024, significantly lower than the standard 18% VAT rate. This strategic move, detailed in Legal Notice 231 of 2023 under the Value Added Tax Act (Amendment of Eight Schedule) Regulations, 2023, aims to bolster the local superyacht industry.

KPMG's Yacht Registration Team provides advisory services to individuals and legal persons wishing to register pleasure or commercial yachts under the Malta Flag. KPMG's Malta Yachting Team gained the trust of yacht owners' who decided to register their pleasure and commercial yachts under the Malta Flag. Our Yachting Team assists yacht ...

This form of taxation is deemed favourable as it strikes a better balance between direct and indirect taxes. The relevance of VAT for boats and yacht owners lies in the fact that VAT liability arises for vessels purchased in or formally imported in EU waters.

The beneficial VAT yacht leasing regime in Malta stands for a long-term charter of a pleasure boat, whereby the VAT incurred on the purchase of the pleasure boat will be deducted immediately and then paid with the lease instalments over the period of the long-term lease. Do you want to learn more about each of the exemptions and check whether ...

The most notable local development from a VAT /tax perspective in the realm of superyachts is undoubtedly the introduction of a special 12% VAT rate on charters commencing in Malta. This was introduced by the Malta tax authorities by virtue of Legal Notice 231 of 2023 titled the Value Added Tax Act (Amendment of Eight Schedule) Regulations, 2023 with effect from 1st January of this year ...

The guidelines regulating the VAT treatment of hiring of pleasure yachts (the "Guidelines") have been amended on 12/03/2020. Whilst still based on Article 59a of the EU VAT Directive, the new Guidelines reflect recent EU developments and best market practices. In terms of the amended Guidelines, the general principle remains that 18 ...

The revised Tonnage Tax Rules in a nutshell. On 17 December, 2017 the European Commission conditionally approved the Maltese Tonnage Tax Rules for a period of ten years. Following such decision the Maltese government introduced legal instruments amending its Tonnage Tax Rules. This was done through the enactment of legal notices 127 and 128 of ...

The Malta VAT treatment of yacht leasing is based on the rules emanating from the EU VAT Directive, the Malta VAT Act (Chapter 406 of the Laws of Malta) and the guidelines on the leasing/hiring of pleasure yachts issued in March 2019. The applicable rules distinguish between: short-term leases: the lease of a yacht for not more than 90 days; and.

With all these tax breaks and other financial benefits, registering a boat in Malta is a smart move. Malta offers lower yacht registration and maintenance charges than other countries, but without sacrificing the quality of service or the distinction associated with flying the Maltese flag. This harmonious blend of affordability and high ...

VAT on Maltese Registered Pleasure Yachts. The Maltese legislation offers third parties the ability to become the owners of an EU VAT-paid yacht with an effective VAT rate of 6.12%, excluding tax and cost transactions which give a risen outlay of 8%. The VAT treatment guidelines on yacht leasing published in 2019, offer parties the ability to ...

VAT Treatment of Yachts intended for Private Use In March 2020, Malta published its guidelines regarding its VAT treatment options establishing the means in which leased pleasure yachts are to be treated for VAT purposes, with a particular focus on the use and enjoyment provisions on yacht leasing supplies.

For Commercial yachts of more than 24 metres, application for Minimum Safe Manning Certificate. Application for Ship Radio Station Licence. Compliance with Commercial Yacht Code for operational certificate. Payment of initial registration fees and annual tonnage tax. The following documents are to be submitted during provisional registration:

When registering your yacht in Malta, you will benefit from VAT minimisation and tax planning down to potentially 5.4%, the reputability of the Malta flag.

Yacht registration whether private or commercial is a very simple and straight forward process subject that all documentation is in order. Yachts are first registered provisionally under the Malta Flag for six months (extendible for a further period, or periods not exceeding in the aggregate six months) during which period all documentation ...

In terms of Legal Notice 231 of 2023, which amended the Eighth Schedule of the Maltese VAT Act (Cap 406 of the Laws of Malta), a reduced VAT rate of 12% shall apply to the yacht charters commencing in Malta. On 29 th January 2024, the Malta Tax and Customs Administration issued guidelines for the application of the reduced 12% VAT rate on the chartering of yachts.

Ship Registration. Ships may be registered in the name of legally constituted corporate bodies or entities irrespective of nationality, or by European Union citizens. Low company formation, ship registration and tonnage tax costs; progressive reduction in registration and tonnage tax costs for younger ships.

Tonnage Tax services in Malta Maltese law requires the payment of an annual tonnage tax by all Malta-registered vessels. Upon payment of such tonnage tax, the annual certificate of registration is issued for the vessel in question and valid for a full year therefrom.

Yachts, cash and tax havens. But Johnston was no stranger to bombast. ... Move to Malta, a new relationship. Johnston's own travels are well documented in his YouTube channel, from short trips ...

Malta recently revamped its rules concerning the importation of yachts used for commercial purpose In principle, the importation of a yacht in Malta is subject to 18% Maltese VAT, payable to the Customs Authorities at point of customs clearance.

A pleasure boat caught fire in Mellieħa on Friday night but its occupants were spared injury as they escaped in time before the flames spread. The boat caught fire at around 10.30pm, a police ...

Kamala Harris unveiled an economic blueprint Friday heavy on popular measures to cut costs for Americans, while attacking powerful companies for price gouging, as she fleshed out her election ...

Why choose the Malta Flag; Vision and Mission; Registration Procedure; Bareboat Charter Registration; Closure of Registry; List of Appointed Ship Surveyors; Manning and Certification of Crew; MLC 2006 & STCW; Seafarer Portal; Mortgages; New Buildings; Small Commercial Yacht Code; Commercial Yacht Code; Commercial Yachting Notices; Passenger ...

Living expense tax allowance might increase ... The boat was boarded and seized by the China Coast Guard east-northeast of Liaoluo Bay outside restricted waters on July 2 Four crew members of a Taiwanese fishing vessel detained by Chinese authorities since July 2 are expected to be released today, but the return dates of the captain and the ...

Romania has dominated Olympic rowing, especially in the women's 8 event, for decades. How do they do it? Read on.