You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Boat Insurance

Start a boat insurance quote and get out on the water..

Or continue previous quote .

Manage Your Boat Insurance Policy

GEICO Marine (formerly Seaworthy) Policyholders

- Log in to GEICO Marine to manage your policy or call (877) 581-BOAT (2628)

- Mon - Fri 8:00 am - 10:00 pm, Sat - Sun 8:00 am - 9:15 pm

SkiSafe Policyholders

- Log in to SkiSafe to your policy or call (800) 225-6560

- Mon - Thu 9:00 am - 7:00 pm, Fri 9:00 am - 6:00 pm, Sat 9:30 am - 5:30 pm

Or call us at (800) 841-3005

Need a boat insurance quote?

Existing boat policyholder?

Get a boat insurance policy to protect your investment.

Boat insurance helps you protect your boat or personal watercraft (PWC) investment. So if you travel across lakes, rivers, or ocean waters of the United States we can help keep your peace of mind afloat. Whether you're looking for a new boat insurance policy or just to save money, we can help you get started with a free boat insurance quote.

Make boating better, together. Experience and a name you can trust go a long way when you're shopping for boat insurance. That's why the GEICO Marine Insurance Company has teamed with BoatUS , the nation's largest group of recreational boat owners. Since 1966, BoatUS has been helping to make boating safer, more affordable, and fun. Together, we share a passion for all things boating.

We all want cheap boat insurance rates, but customer service matters too. Protect your investment with boat insurance you can count on and get your free online boat insurance quote today.

Why do you need boat insurance?

A boat insurance policy helps protect you and your boat. If you don't have a separate boat insurance policy, you're probably underinsured. This could mean paying a lot out of pocket for accidents outside your control. Many homeowners policies cover minor boating risks but don't cover your needs sufficiently due to:

- Size restrictions

- Limitations on horsepower

- Limits on damage coverage

Check out our "boating insurance explained" video and article here for more reasons why boat insurance is a smart idea.

Boat insurance can provide coverage for:

- Damage to your boat including hull, sails, equipment, and more.

- New boat replacement

- Fuel spill liability

- Liability to pay for damages and injuries you cause if you hit another boat, person, dock

- Medical coverage for you and persons in your boat.

- Wreckage removal

What types of watercraft are covered by boat insurance?

All boats aren't the same. You need to customize your boat insurance to meet your needs and provide your watercraft with the proper coverage. Here is a list of the most common types of watercrafts.

- Pontoon boats are one of the most popular inland water boats. They are a flattish boats that rely on floats to remain buoyant. Their wide and spacious area is great for many passengers to enjoy the ride.

- Personal watercraft (PWC) are powered by a water jet pump and the rider generally sits, stands, or kneels on it. There are many types of PWCs which include WaveRunners, Sea-Doos and more.

- Fishing and bass boats are designed and equipped for fishing. Most are powered by an outboard motor and are equipped with power poles, trolling motors, etc.

- Powerboats are the most popular type of boat used for cruising, watersports, and so much more.

- Sailboats are propelled partly or entirely by sails.

If you don't see your watercraft listed and are looking for more information on different types of boats and insurance for boats, check out our boat FAQ page .

What does boat insurance cover?

A policy insures your boat against damage and loss caused by common risks, such as collision, fire, storms, and theft. Boat insurance may also help protect you if you accidently injure someone or damage their property with your boat.

Service and Claims

When you choose GEICO Boat Insurance, you have access to:

- Licensed agents as passionate about boating as you are

- Specialized service including 24/7 claims handling and towing

- Experience you can rely on

24/7 Boat Towing*

GEICO Marine Insurance Company has teamed with TowBoatUS, the nation's largest towing fleet to provide:

- 24/7 boat towing assistance

- On the water towing services provided by TowBoatUS

- Fuel delivery services

- Digital dispatch through the BoatUS app and more

Personal Watercraft (PWC) Insurance Coverage

You can get a boat policy for your PWC. Typical PWC insurance coverage includes:

- Damage to another craft or dock

- Physical damage to your watercraft

- Towing assistance

How much does boat insurance cost?

Boat insurance is based on the type of boat, length, number of engines and horsepower, how you use it (recreation, commercial charter, racing, etc.), and how and where it will be stored. All of these factors, including the experience and claims record of the owner will factor into the cost of boat insurance.

You could save even more with these boat insurance discounts.

We know discounts and our watercraft insurance agents can help you get them to help you save on your boat insurance quote.

Multi-Policy Discounts

If you're a current GEICO Auto Insurance policyholder, you could save on your boat insurance .

Boat Safety Courses

We know that safety comes first when you're having fun on the water. When you pass boat safety courses, you could save money on your boat insurance. Haven't taken one yet? Check out available courses from the BoatUs Foundation Site.

Need to speak with a boat insurance sales representative?

You can reach us at (855) 395-1412

- Mon - Fri 8:00 AM - 10:00 PM (ET)

- Sat - Sun 8:00 AM - 9:15 PM (ET)

Boat Insurance: Get the answers you're looking for.

- Is boat insurance required? Boat insurance liability coverage is only mandated in a few states, so always check insurance requirements for the state you're boating in. Physical damage coverage is required by your lender if you're financing your boat or watercraft. If you keep your boat at a marina, the marina may require you to have liability coverage.

- Liability to pay for damages and injuries you cause if you accidentally hit another boat, person, or dock

There are some types of watercraft that can't be added to a new or existing GEICO boat policy:

- Airboats, amphibious land boats or hovercraft

- Boat with more than 4 owners

- Boats over 50 feet in length

- Boats over 40 years old

- Boats valued over $2,500,000

- Floating homes

- Homemade boats

- Houseboats that do not have motors

- Steel hulls

- Wooden hulls

- Watercraft previously deemed a constructive total loss

- Does boat insurance cover theft? Our Ageed Hull Value, and Actual Cash Value policies protect against damage to your watercraft from incidents out of your control, including theft.

- How do I make a payment or manage my boat insurance policy? Managing your boat insurance policy and making payments is easy in the BoatUS app. You can also manage your policy or make payments online , or by calling (800) 283-2883 .

- How do I report a claim on my boat insurance policy? You can report your claim through the BoatUS app. Claims can also be reported online , or by calling (800) 937-1937 .

GEICO has teamed up with its subsidiary, BoatUS, to bring boaters a policy developed by specialists, with the great service you expect from GEICO. Policies are underwritten by GEICO Marine Insurance Company. BoatUS—Boat Owner's Association of The United States—is the nation's largest association for recreational boaters providing service, savings and representation for over 50 years.

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages. Some discounts, coverages, payment plans, and features are not available for all customers, in all states, or in all locations.

*Boat and PWC coverages are underwritten by GEICO Marine Insurance Company. The TowBoatU.S. Towing Coverage Endorsement is offered by GEICO Marine Insurance Company, with towing services provided by the BoatU.S. Towing Program. Towing coverage only applies to the insured watercraft.

Colorado Language Preference

Are you a resident of or looking for insurance in the State of Colorado?

We are temporarily unable to provide services in Spanish for Colorado residents. You will now be directed to an English experience.

Estamos encantados de ofrecer nuestra nueva version del sitio web en Español. Apreciamos su paciencia mientras seguimos mejorando su experiencia.

When you use links on our website, we may earn a fee.

Best Boat Insurance of 2024

Table of Contents

- Best Boat Insurance

- How to Find

- Do You Need It?

Boat insurance is a type of coverage designed to protect boat owners and their personal property in the event of an incident on the water. The best boat insurance companies offer flexible coverage options for a variety of vessels, with reasonable premiums and lots of additional benefits.

Every person who owns or operates a boat should consider carrying boat insurance , as it protects them against personal liability if they’re in an accident, as well as guarding them against loss if something happens to their vessel. In this guide, we’ll explore some of the best companies that offer boat insurance, what they offer, as well as their benefits and drawbacks. We’ll also discuss special coverage options for particular use cases or types of boats.

- Best Overall: Geico Marine »

- Best for Fishing Enthusiasts: Markel »

- Best for Yacht Owners: Chubb »

- Best for Jet Ski and Personal Watercraft Owners: SkiSafe »

- Best for Houseboats: American Family »

- Best for Discounts: Progressive »

Best Overall: Geico Marin e

Insures boats up to 50 feet in length

Gives policyholders access to BoatUS Catastrophe Team

Insures boats valued up to $2.5 million

Doesn’t insure wood or composite boats

Boats more than 40 years old aren’t eligible for coverage

Geico Marine has been writing boat insurance since the 1980s. Originally established as Seaworthy Insurance, the company was bought by financial giant Berkshire Hathaway in 2007.

Under the Geico umbrella, Geico Marine offers insurance designed to meet the needs of the vast majority of boat owners. The list of boats that are ineligible for coverage by Geico is far shorter than those that are. Disqualifying criteria include:

- Boats over 50 feet in length

- Boats over 40 years old (15 years for houseboats)

- Multihull sailboats (catamarans)

- Watercraft made of wood or composite material

- Homemade boats

- Amphibious land boats or hovercraft

- Boats previously deemed a total loss

- Boats valued over $2,500,000

In addition to its strong lineup of coverages, Geico Marine insurance also comes with 24/7 assistance. Additionally, the company has a long-standing association with The Boat Owners Association of the U.S. (BoatUS), including giving policyholders access to the BoatUS Catastrophe (CAT) Team. The BoatUS CAT Team is a group that brings considerable resources to bear – including towboats and cranes – to help BoatUS members and Geico customers recover and salvage their vessels after a natural disaster.

Coverages Offered:

- Not disclosed

Exclusions:

Navigational Limits:

Discounts and Benefits:

Salvage Coverage:

- 24/7 assistance dispatch

- Access to BoatUS Catastrophe Team

Insurer Financial Strength:

- A++ (Superior) rating by AM Best

Best for Fishing Enthusiasts: Markel

Special coverage for rods, reels, and other equipment

Emergency towing and personal property coverage included

Lift and trailer coverage available

Claims can take a few weeks to settle

Some negative customer reviews online

Specialty insurer Markel is another provider of boat insurance. Markel boat insurance policies come with multiple coverages included and even more optional coverages available, including many not available from other insurers. Several of these special coverages are geared towards fishing enthusiasts, including both amateurs and professionals.

Among Markel’s special coverages for fishers are protections for rods, reels, and other personal effects, plus coverage for boat lifts and trailers. The company even offers professional angler liability coverage and tournament fee reimbursement as optional add-ons.

However, according to Markel’s documentation and customer reviews online, the company can take up to several weeks to settle claims. This is somewhat longer than some other providers. Customers have also noted that claims can take longer and be more involved, increasing the time it takes to get boats repaired or replaced.

- Watercraft liability

- Medical payments

- Agreed value watercraft and equipment

- Emergency towing

- Personal effects

- Uninsured/underinsured boater

- Pollution liability

- Replacement cost settlement

- Boat lift

- Trailer

- Fishing equipment

- Professional angler liability

- Tournament fee reimbursement

- Crash damage

- Theft coverage

- Theft away from home

- Wreck removal

- Cost of gas, oil, parts, or a loaned battery in the event of a breakdown

- Experienced boater

- Vanishing deductible for loss-free boaters

- Multi-boat policy

- Outboard propulsion

- Primary operator age 40 and over

- Diesel engine

- Wreck removal coverage included

- A (Excellent) rating by AM Best

Best for Yacht Owners: Chubb

Coverage designed specifically for yacht owners

High coverage limits available for captained vessels

Vessels must be 36 feet longer or greater to qualify for yacht coverage

Crew required for vessels over $3 million

Global insurer Chubb is one of the few large carriers that offers boat insurance designed specially for yachts, including those over 70 feet in length with professional captains and crews.

Yacht insurance from Chubb is available for pleasure cruisers at least 36 feet long (and valued up to $3 million), as well as captained yachts at least 70 feet long and valued at $3 million or more.

Among the niche yacht coverages available from Chubb are:

- Search and rescue

- Longshore and harbor workers’ compensation

- Boat show and demonstration

- Oil Pollution Act

Yacht insurance from Chubb can even include temporary substitute watercraft, so you can still enjoy the water if your yacht is damaged and requires repairs.

- Agreed value

- Liability protection for both owner and crew

- Replacement cost loss settlement

- Uninsured/underinsured boater

- Medical payments

- Search and rescue

- Longshore and harbor workers’ compensation

- Personal property and fishing equipment

- Marina

- Boat show and demonstration

- Precautionary measures

- Bottom inspection

- Oil Pollution Act (OPA)

- Temporary substitute watercraft

- Marine environmental damage

- Emergency towing and assistance

Best for Jet Ski and Personal Watercraft Owners: SkiSafe

Coverage specifically designed for personal watercraft

Vessels are still covered during winter lay-up periods

Water sports liability coverage is included

No coverage for commercial use

$25,000 limit for no-fault medical payments

Specialty provider SkiSafe is one of the biggest personal watercraft insurers you’ve never heard of. The company doesn’t underwrite its own policies; that’s handled by AXIS Insurance Co., a large Bermuda-based insurer. SkiSafe has been around for nearly 50 years and insured more than half a million boaters.

Boat insurance from SkiSafe is designed to meet the needs of personal watercraft owners. As a result, coverages are fairly consolidated and focus specifically on the reduced needs of these types of boaters. Naturally, there is a heavy focus on coverage for injuries, including related to water sports. However, there are also special savings related to lay-ups, since the season for personal watercraft can be relatively short compared to other types of boats.

- Physical damage

- Bodily injury

- Medical payments ($25,000 limit for no-fault medical payments)

- Water sports liability

- Commercial use is not covered

- Roadside assistance

- Policies have stated navigational limits

- Owners can’t take vessels to another country without prior approval

- Boating safety course

- Clean driving record

- Restricted navigation territory

- Multi-craft

- Winter layup

- AXIS Insurance Company is rated A+ (Superior) by AM Best

Best for Houseboats: American Family

Special coverage designed specifically for houseboats

Up to $100,000 of personal effects coverage available

Boats up to 54 feet can be covered (40 feet in Georgia)

A marine survey may be required

Must work with a local agent to buy coverage

American Family is unique among boat insurance carriers in that it’s one of few that offers a policy designed specifically for houseboats. Included in American Family houseboat policies are several coverages that cater specifically to these types of vessels, including up to $100,000 for your personal property in case items are stolen, damaged, or fall into the water.

Houseboat insurance from American Family may lack some coverages you might find with other types of vessels, such as emergency towing or parts delivery (these are included in some boat policies from American Family, but it’s unclear from the website whether they’re included in houseboat policies). Additionally, these policies have restrictions specific to houseboats, including horsepower limitations. But, American Family also offers unique discounts particularly helpful for houseboat owners.

- Property damage (liability)

- Medical expenses

- Watercraft equipment

- Houseboat repair cost

- Total loss agreed value

- Houseboats can’t be used as a permanent residence

- Vessels can’t be used for business purposes (separate coverage required)

- Boats must be 54 feet or shorter (40 feet in Georgia)

- Vessel MSRP must be less than $250,000

- 500 horsepower limit for single-engine boats and 1,000 for dual-engine craft

- Boating safety features

- Autopay and paperless

- Premium paid-in-full

- Multi-policy bundling

- Diminishing deductible

Best for Discounts: Progressive

Numerous discounts available

Can buy coverage online

Up to $1,000 of coverage if a pet is hurt or killed in a boating incident

Lots of limits on boat length and value

Many types of vessels are ineligible for coverage

Rounding out our list is insurance giant Progressive, which also has a strong boat insurance offering. Progressive has been insuring boats for more than three decades and insures more than 1 million vessels. Its policies should meet the needs of most owners of boats less than 50 feet long and worth less than $500,000.

Where Progressive really shines, though, is in its list of available discounts. Progressive offers boaters not just the standard discount opportunities available with other insurers, such as multi-policy, multi-boat, or paid-in-full discounts. Progressive also offers savings simply from switching coverage from another country. Additionally, accident forgiveness is also available for incidents both large and small.

- Full replacement cost

- Bodily injury

- Property damage liability

- Water sports

- Total loss replacement (optional)

- Fishing equipment or carry-on item (optional)

- Mechanical breakdown (optional)

- Comprehensive (optional)

- Collision (optional)

- Uninsured/underinsured boater (optional)

- Medical payments (optional)

- Trailer trip interruption (optional)

- Boats less than 10 years old must be worth $500,000 or less

- Boats 11 to 20 years old must be worth $350,000 or less

- Boats more than 20 years old must be worth $75,000 or less

- Boat can’t be used as a primary residence (liveaboards)

- Houseboats must have motors

- Homemade boats without a hull identification number are ineligible for coverage

- Boats can’t have more than two owners

- Boats can’t have steel or wood hulls

- Amphibious land boats, hovercraft, and airboats worth more than $27,000 are ineligible

- Boats must meet published U.S. Coast Guard standards

- Boats must also be 50 feet long or shorter (limits can be 35 feet and $175,000 in value in some states)

- Multi-policy

- Multi-boat

- Responsible driver

- Original owner

- Transfer from another company discount

- Associations (including United States Coast Guard Auxiliary, United States Power Squadron, USAA members in some states)

- Advanced quote

- Pay in full

- Prompt payment

- Safety course

- Small-accident forgiveness

- Large-accident forgiveness

- Disappearing deductibles

- Wreckage removal

- On-water towing (optional)

- A+ (Superior) rating from AM Best

The Bottom Line

Boat insurance is a highly individual product, much more so than auto or home insurance. Because boat owners’ needs vary greatly, it’s important to research providers to find the right carrier for your vessel and use case. Based on our research, we found that Geico is the best insurance company available for the widest array of vessels and the most common types of uses.

How to Find the Best Boat Insurance

Here are some essential tips to keep in mind when looking for the best boat insurance policy:

- Evaluate your coverage needs. Based on your boat's value, usage, and legal requirements, determine the type and level of coverage required.

- Compare quotes. Obtain quotes from multiple insurers to compare premiums, coverage options, and discounts.

- Review policy details. Carefully examine the policy's coverage limits, deductibles, exclusions, and additional benefits.

How to Save on Boat Insurance

When seeking to lower the cost of your boat insurance, consider:

- Maintaining a clean driving record. Even though you will be driving a boat and not a car, your record on the road can still be taken into account since many insurers link good driving with good boating.

- Improving your credit score. Maintaining a good credit score can also lower your premiums.

- Searching for discounts. Inquire about discounts, such as those for taking a boating course, being an experienced boater, or having outboard propulsion.

- Bundling policies. Save money by bundling your boat insurance with home or auto insurance policies.

- Raising deductibles. Opting for a higher deductible can lower your premiums, but ensure you can cover the out-of-pocket costs if you need to file a claim.

- Getting a marine survey. This will tell you how much your boat is worth, enabling you to get a more precise quote from your insurer.

- Making as few small claims as possible. Just like with other kinds of insurance, the more claims you make, the higher your premiums will be.

Do You Need Boat Insurance?

Whether you need boat insurance depends on various factors, including legal requirements and your personal circumstances. You should consider:

- State requirements. Some states require boat insurance, especially for larger or more powerful vessels. Check your state's regulations to determine if insurance is mandatory for your boat.

- Marina requirements. Many marinas require proof of insurance to dock your boat. This ensures you have coverage for potential damage to the marina or other boats.

- Protection. Boat insurance can cover a range of risks, including damage to your boat, liability for damages to a third party’s items, third party injuries, theft, and medical payments.

How We Chose the Best Boat Insurance

To identify the best boat insurance, we reviewed offerings available from numerous reputable carriers. We focused primarily on those with solid financial ratings and comprehensive coverage options to meet the needs of a wide array of boaters. We then narrowed down our selections to those providers with best-in-class offerings specifically designed to meet certain types of boaters.

WHY SHOULD YOU TRUST US?

At U.S. News 360 Reviews, our contributors and editors have years of experience researching and reviewing complex financial topics including insurance policies. Dock David Treece , the author of this piece and a senior contributor for 360 Reviews, has more than two decades of experience in the finance and insurance industry. He has covered insurance and other financial topics for Forbes, Investopedia, Business.com, and other publishers. He has also written for several insurers, including Progressive.

Boat insurance is not required in most states. However, if you have a loan secured by a boat, most lenders require that you buy boat insurance. Additionally, boat insurance can protect owners and operators against personal liability if they’re involved in an accident.

When you buy boat insurance, you’ll need to provide several pieces of personal information, as well as information about your boat and applicable licenses. Depending on the type of boat and policy, you may also be required to submit a marine survey, which assesses the condition of your vessel.

Boat insurance does not typically have a waiting period before you can file a claim.

Some insurers allow policyholders to insure multiple boats under the same policy, so long as they all have the same owner(s). Many carriers also offer discounts for owners who insure multiple boats with the same company.

Depending on the size, type, and value of the vessel being insured, some carriers require a boat to undergo an inspection (called a marine survey) in order to assess the boat’s condition prior to binding coverage.

The amount of boat insurance you need depends on your boat's value and how you plan to use it. It should cover your boat's replacement cost, and you should also consider purchasing liability coverage for accidents, medical payment coverage for injuries, and coverage for theft of personal belongings.

Homeowners insurance might offer limited coverage for small boats under certain circumstances, like damage caused by fire or theft while on your property. However, larger or high-performance boats typically require separate boat insurance for comprehensive coverage.

U.S. News 360 Reviews takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Hurricane and Tropical Storm Information ACTIVE STORM TRACKER

Service Locator

- Angler Endorsement

- Boat Towing Coverage

- Mechanical Breakdown

- Insurance Requirements in Mexico

Agreed Hull Value

Actual cash value, liability only.

- Insurance Payment Options

- Claims Information

- Towing Service Agreement

- Membership Plans

- Boat Show Tickets

- BoatUS Boats For Sale

- Membership Payment Options

- Consumer Affairs

- Boat Documentation Requirements

- Installation Instructions

- Shipping & Handling Information

- Contact Boat Lettering

- End User Agreement

- Frequently Asked Questions

- Vessel Documentation

- BoatUS Foundation

- Government Affairs

- Powercruisers

- Buying & Selling Advice

- Maintenance

- Tow Vehicles

- Make & Create

- Makeovers & Refitting

- Accessories

- Electronics

- Skills, Tips, Tools

- Spring Preparation

- Winterization

- Boaters’ Rights

- Environment & Clean Water

- Boat Safety

- Navigational Hazards

- Personal Safety

- Batteries & Onboard Power

- Motors, Engines, Propulsion

- Books & Movies

- Communication & Etiquette

- Contests & Sweepstakes

- Colleges & Tech Schools

- Food, Drink, Entertainment

- New To Boating

- Travel & Destinations

- Watersports

- Anchors & Anchoring

- Boat Handling

- ← Products & Services

- Payment Options

Boat Insurance

Get a Quote 800-283-2883 | File a Claim 800-937-1937

Boat Insurance From Experts – BoatUS and GEICO have teamed up!

Get a Quote

Retrieve a Quote

Self Service

Policies are underwritten by GEICO Marine Insurance Company. Privacy Policy & Notice of Collection

If GEICO Marine is unable to offer a quote, your information may be shared with non-affiliated insurance companies, CHUBB and American Modern, so that they may provide a quote. Both of these non-affiliated insurers have sole financial responsibility for its own insurance products. By clicking “Get a Quote,” you agree that the information you provide can be shared with our business partners.

Login to My Account, the place to conduct all your BoatUS business online on one secure site, anytime, anywhere. Make a payment and manage autopay options, view your policy summary, retrieve policy documents, upload claim photos and documents, update your credit card, contact and boat information, and more!

BoatUS and GEICO have teamed up to bring boaters a great boat insurance policy at a great price. Serviced by boating experts our coverage options for boaters of all kinds can’t be beat.

Check out our policies and add-on coverage options for a custom policy you can only find here.

The best marine insurance protection for your boat, engine and gear. Pays you the most in the event of a claim — the agreed value when you buy the policy for total losses and parts are replaced "new for old." Available for all boat types, excluding PWC.

This boat insurance coverage lowers your premium by paying you the current market price for your boat in the event of a total loss. Recommended for smaller boats, personal watercraft and boats without a lien holder.

Our lowest cost marine insurance policy providing essential liability coverage to protect your assets without the added cost of hull coverage. Includes salvage and wreck removal. Available for boats with no lien holder.

Custom Add-on Coverage Options

Provides liability coverage that may be required by a marina's dock contract.

Allows for paid passengers for the purposes of fishing, sight-seeing, or day cruises. Maximum of 6 passengers onboard plus the captain while being used for charter.

Usually excluded, this endorsement provides coverage for ice and freeze damage if you have your boat winterized by a marine professional.

Provides a guarantee for claims-related repairs made at an approved facility for as long as you own and insure the boat through BoatUS. (Available with Agreed Hull Value Coverage only.)

This endorsement lowers the deductible for claims relating to the dinghy and/or the dinghy's motor resulting from theft or damage to $100.

This endorsement lowers the deductible for claims relating to navigational electronics to $250.

Provides coverage to the lower unit of the insured outboard engine and outdrive due to mechanical breakdown which is usually excluded in the policy. Available with Agreed Hull Coverage only. Disappearing deductible does not apply. Click here for additional information.

Coverage for fishing and watersports equipment and personal items such as cell phones, tablets, stereos and clothing lost or damaged while on board or while being loaded or unloaded from the boat. For competitive anglers or water sport enthusiasts, Tournament Reimbursement fees are also covered under Personal Effects.

To ensure that you or your family do not incur large out-of-pocket expense if injured onboard, our policies also include an additional $25,000 for payments not covered by any major medical policy. This coverage is in addition to the medical payments limit you select with your policy.

Get Unlimited Towing from TowBoatUS at our lowest price - as little as $3 a month for the insured boat. Pricing varies with the length and location of your boat. Click here for additional information.

When you insure your trailer, roadside assistance while trailering your boat is included.

Unlimited Towing from TowBoatUS – the Nation’s Largest Fleet

Add Unlimited Towing to your boat policy for as little as $3 a month based on boat size and location.

Easy Payment Options

Paying your insurance premium is quick, easy and affordable with auto-pay and installment payment options. View All Payment Options

For a quote, visit our Online Application or call 800-283-2883 for personal service.

All coverage is subject to terms, conditions, limits and exclusions of the policy. Not all policy options are available in all states. Boat and PWC policies are underwritten by GEICO Marine Insurance Company with administrative offices at 5323 Port Royal Road, Springfield, VA 22151. GEICO Marine Insurance Company is domiciled in Omaha, NE, and coverage is offered in all 50 states and the District of Columbia to boat owners with a U.S. address. View the GEICO Marine Insurance Company Privacy Policy & Notice of Collection .

We use cookies to enhance your visit to our website and to improve your experience. By continuing to use our website, you’re agreeing to our cookie policy.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Boat Insurance: An In-Depth Guide

Amy is a former editor and insurance authority at NerdWallet. She has been helping consumers understand insurance choices and terminology for almost 20 years.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Do you need boat insurance?

What boat insurance will pay for, boat insurance costs and discounts, where to buy boat insurance.

Your prized boat probably didn’t come cheap. Whether you own a bass fishing boat or a yacht, it’s important to find the right boat insurance that will come to the rescue if you have damage or theft. Here’s how to understand boat insurance policies.

Your home insurance policy covers your boat in some cases, but it doesn’t go far. Homeowners policies typically cap boat coverage at $1,000 or 10% of your home’s insured value. And liability coverage — which pays for damage your boat does to others — typically isn’t included under home insurance. So a home insurance policy might help you only if your boat is small, slow and inexpensive.

At a glance: Do I need boat insurance?

You can typically buy liability insurance — which pays for damage your boat does to others — in amounts from $15,000 to $300,000, according to the Insurance Information Institute. Here's what else you can expect from a policy:

Check, too, about additional coverage for trailers and accessories, for towing and for damage caused by an uninsured boater.

You can buy two types of damage coverage for a boat:

Actual cash value. This pays the value of your boat at the time of the damage. If your boat is destroyed, your insurance company determines its market value.

Agreed amount value. If your boat is destroyed, your insurer pays you an amount that you and the company agreed on beforehand. If your boat can be repaired, your insurer replaces old items for new ones without deducting for depreciation.

It’s also important to understand what your boat insurance covers before heading out on the water, says Todd Shasha, boat and yacht personal insurance director at Travelers Insurance. He recommends checking whether your policy can cover these scenarios:

Mechanical breakdown coverage. Pays to repair or replace your outboard motor as long as it’s not due to wear and tear.

Salvage. If your boat becomes disabled and a basic tow won’t help, you might need to call a salvage company to recover it. Typically a salvage company will ask for a percentage of the boat’s value as payment, which can be quite expensive. Not all insurance companies offer this coverage.

Gadgets. Not all boat insurers cover expensive accessories like fishing equipment or fancy coolers unless they’re permanently attached to the boat. For example, Travelers offers personal property coverage that pays you if they’re stolen or lost while out on the water. Endorsements, which are additions to your policy, are available if you want to increase the value of your personal property limits.

Some important things to know about boating and your policy:

Navigational limits: If you own a yacht or a larger boat, your policy will have limits outlining where you can navigate your vessel. If you venture outside of the territory you agreed to in the policy, your insurance may not cover you. Typically, the broader your navigation area is, the higher your insurance costs will be.

Layup periods: Taking your boat out of the water is typical during cold weather, and most insurance companies will give you a credit because it’s not being used. But take the boat out for a spin before the layup period ends and you won’t be covered by your insurance policy.

Marine inspections: If your boat is an older model, most insurance companies will want you to have it inspected by a marine surveyor in order to assess the vessel’s condition and market value. For safety’s sake, consider a marine survey even if it’s not required.

Underage operators: You might be tempted to let your 12-year-old drive the boat every now and then. But if your child doesn't meet age and license requirements in your state, your boat insurance policy might not cover you. Age and license requirements for operating personal watercraft vary from state to state. In Virginia and Florida, for example, no one under 14 may operate a personal watercraft. In Texas, children under 13 are barred from driving one unless a licensed operator who's at least 18 is on board. For requirements where you live, check with the boating regulatory agency in your state.

How much you’ll pay for boat insurance depends on the level of insurance coverage you want, as well as the size, horsepower, type and value of your boat.

You can choose your deductible, which is the amount deducted from your insurance check if you make a claim. A typical policy has deductibles of $250 for property damage, $500 for theft and $1,000 for medical payments, according to the Insurance Information Institute. Liability claims against you do not have a deductible.

Insurance companies offer a variety of ways to save money, including discounts for:

Having a diesel-powered boat.

Not having made a previous boat insurance claim.

Carrying other policies, such as car or homeowners, with the same insurer.

Taking safety courses.

Boat insurance is widely available. NerdWallet looked at the top 25 auto insurance sellers in the country and found these that also offer boat insurance:

Offers coverage for boats up to $250,000 in value.

AAA lowers your deductible by 25% each time you renew your policy and haven’t had a claim.

Average cost of boat insurance from Allstate is about $20 a month, according to Allstate.

Bundle boat insurance with an Allstate homeowners policy and you qualify for up to a 20% discount.

American Family Insurance

Additional coverage options cover personal items and pay for repairs to your boat and equipment, without a deduction for depreciation.

If your boat is disabled, an Amica policy covers towing to nearest port.

If your yacht can’t be repaired, Amica pays to replace it with a new one, without subtracting depreciation.

Auto-Owners

Optional boat insurance coverage is available through homeowners policies.

Country Financial

Country Financial homeowners insurance covers your boat for up to $1,500.

You can buy more coverage under your homeowners policy.

Erie’s standard Boat Protector Policy comes with extras, including payments up to $500 to fix or replace boating equipment and accessories, and payments up to $250 for emergency towing. (Not available in Kentucky.)

Farmers offers seven packages to fit your vessel type and coverage needs.

Geico’s optional premium boat towing service offers unlimited on-water towing (within 25 miles of an approved tower) and pays the service provider directly.

Geico offers several discounts, including one for passing a boat-safety course and for maintaining a good driving record.

You can cover your boat, sailboat or personal watercraft with an endorsement to your Hanover Platinum or Connections homeowners insurance policy.

The Hartford

Additional coverage, which costs extra, is available for your accessories, trailer and boat hull.

Liberty Mutual

You must have a homeowners insurance policy with Liberty Mutual to get boat and watercraft insurance.

Optional coverage includes hurricane protection, which pays up to $250 to move your boat out of danger during a hurricane advisory.

Unforeseen emergency services coverage pays $250 for towing and other services on land or in the water.

Personal watercraft coverage includes liability, collision, comprehensive, uninsured or underinsured operator, and medical payments.

Optional towing and labor also available.

Progressive

Total loss replacement coverage pays for a new boat if your new boat is a total loss within five years of adding the coverage.

Progressive offers several specialized coverage options, including 24-hour roadside assistance if your car breaks down while towing your boat.

Unlike some insurers, Progressive doesn’t require you to submit a navigation plan. Nor does it require an inspection of your boat.

State Farm’s optional emergency service pays up to $500 to service your boat, motor or boat trailer.

Optional wreck-removal coverage pays “reasonable expenses” to raise or remove your boat when it’s required by law.

Travelers splits the cost to move the vessel to safety when you carry “hurricane-escape reimbursement” coverage, which costs extra.

Antique boats get the same comprehensive coverage available in Travelers' basic policy.

USAA members get a 5% discount on boat insurance, but the discount is not available in all states.

USAA is open only to active and retired military and their families.

Juan Castillo is a former staff writer at NerdWallet.

On a similar note...

Yacht In s urance

The best yacht insurance rates.

From America's boat insurance experts since 1984

Get a Quote

- Marine Insurance

- Boat Insurance Quote

- Company Information

- Testimonials

- Boat Safety

- Boat Towing

- Boat Insurance Guide

- Yacht Insurance

- Insurance Glossary

- Report A Claim

- California Boat Insurance

- Maryland Boat Insurance

- Michigan Boat Insurance

- Texas Boat Insurance

- North Carolina Boat Insurance

- New York Boat Insurance

- Florida Boat Insurance

- Minnesota Boat Insurance

- Louisiana Boat Insurance

The Differences between Boat & Yacht Insurance

When you look at a boat insurance policy, you'll notice the language is unlike your typical homeowner's or auto policy. What you may not know is that vessel insurance can even vary from policy to policy, depending on a variety of factors.

Yachts are classified as vessels 27 feet or more in length, while boats are 26 feet or less. No matter what type of vessel you have, when it comes to the type of policy, seek out Agreed Value. Agreed Value policies are cover all damages, except for sails, outboard motors, canvas covers, cushions or other specified items. They do not reflect depreciation or market value, which means you will get a greater settlement in the event of a claim. Other policies such as Actual Cash Value may be cheaper, but they also factor in depreciation and market value and will subtract that from your payout.

Also, when it comes to navigation limit, boat and yacht insurance policies can vary due to different exposures. For example, a boat policy typically includes unlimited overland transportation on a trailer, while a larger yacht policy would restrict overland trailering to only several hundred miles.

Deductible amounts can also differ. A yacht policy can offer deductibles of up to 3 percent for any hull damage. However, deductibles for a total loss, marine electronics loss or a windstorm loss can vary depending on your particular policy. By contrast, a boat policy offers a flat deductible, typically of $250, $500 or $1,000.

Because yachts inherently incur more risk due to their size and navigation, the liability feature of yacht insurance provides broad coverage designed to shield you from the effects of the maritime law. Your coverage is much broader than with a typical watercraft liability policy, and offers protection to permissive users, captain and crew liabilities, along with the Jones Act, a federal law that allows a seaman who gets injured on the job to bring a suit for damages against his or her employer.

Besides, yacht insurance addresses salvage to a damaged yacht, legal liability to remove a sunken wreck and uninsured boater coverages. In a typical boat policy, only general liability protection is included. For example, if your boat sinks in the Great Lakes or any of its tributaries, the U.S. Coast Guard says it must be raised. There will be salvage costs, fuel clean-up - and you'll have to pay the bill regardless of your coverage.

While most yacht policies provide salvage coverage, they do so in different ways. Some choose to limit the dollar coverage to a stated amount or percentage of the hull amount.

Another very important part of the salvage issue is wreck removal. Some companies include wreck removal under their hull coverage, which then limits its value. A true yacht policy will include it under the protection and indemnity limit, which will provide much higher limits and additional coverage.

Get Your Insurance Quote

Another difference is that in yacht policies, your legal defense is in addition to protection and indemnity limits, while boat policies offer legal defense within the limit of liability.

Yacht policies have warranties, including the seaworthiness, navigation limits territories and navigation lay-up limits. While some boat policies do not require warranties, others may incorporate them.

Many boaters consider adding their vessels to their homeowner's insurance in an attempt to reduce their costs. Although the cost is substantially less when you add a boat to a homeowner's policy, but you don't get near the coverage. In this case, the old adage still holds true - you get what you pay for. The bottom line is not the amount of your policy premium, but how much you will collect at the time of loss.

For more information on boat and yacht insurance, or to talk to an experienced agent about different coverage options, contact NBOA Marine Insurance. Representing several A+ rated carriers, their insurance specialists will be able to create a customized policy that fits your specific needs and would be happy to answer any questions you may have.

Call 1-800-248-3512 or start your online boat insurance quote today.

CELEBRATING 35 YEARS AS ONE OF THE NATION'S TOP INSURANCE PROVIDERS!

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

We'll Help You Find the Best Boat Insurance in Minutes

Our nationwide network of local independent agents is ready to help you find the perfect coverage at the best rate..

TrustedChoice.com Article

How will this quote help me?

Your quote is based on several common factors to give you a clear picture of the cost you can expect, though an independent agent can shop around and maybe even improve your rate!

NOTE: This quote is not final, though we did work with professional actuaries to help get you a ballpark figure to get started.

Do you have to have boat insurance on a boat?

Only two states require boat insurance by law, but there are a few instances where you may need it. If you dock your boat at a marina, they may require some form of coverage in order to protect their business. Also, if you finance your boat, nearly every lender will require coverage to protect their investment; use our list of the best boat insurance companies as a starting point.

Other than that, you should always have at least liability coverage on your boat to protect yourself against lawsuit costs if you cause bodily injury or property damage to another party. Property coverage is optional, but again, the more comprehensive your coverage, the better it can protect you.

How much is boat insurance?

The cost of any boat insurance policy depends on a number of factors, including your boat's size, value, and horsepower. Boat insurance policies can range from the low hundreds to tens of thousands of dollars annually, depending on what kind of coverage you need.

Do I need to insure my boat trailer?

Insuring your boat trailer is always a safe bet. Though your boat trailer may be protected by your home or car insurance policy, you can also add coverage to your boat insurance for your trailer. It's best to talk to your independent insurance agent about your boat, the trailer, and how you use it to determine the right coverage amount.

Does boat insurance cover passengers?

If your policy includes medical payments coverage, it will cover injuries to your passengers if you get into an accident. Medical payments coverage is an important option because just one accident can cause injuries that are extremely costly to treat.

Does boat insurance cover theft?

Typically, yes. But it's important to review your specific boat insurance policy with your independent insurance agent to make sure. Every carrier and every policy is different, but the more you know about your own policy, the better it will help protect you.

Does boat insurance cover hurricanes?

In most cases, yes, your boat will be covered against hurricane damage. But, as with any other natural disaster or unexpected event, you'll want to double-check your policy.

Does boat insurance cover engine damage?

No, boat insurance often excludes defective machinery or maintenance costs. Wear and tear is a natural outcome of use and not covered by your policy.

What is the cost difference in insuring different kinds of boats?

The size and value of your boat are two of the most impactful features on the cost of your coverage. Insurance for a $20,000 boat can cost an average of only $300 per year, while insuring a $2 million yacht can cost as much as $30,000 per year.

Does boat insurance cover me if I hit a rock?

If you have collision coverage on your boat insurance, you should be covered for the cost of repairs if you hit a rock.

Does boat insurance cover a blown engine?

In certain cases, boat insurance may cover a blown engine if the disaster was due to a listed peril. For example, ice and freeze damage to engines is typically covered. However, blown engines due to the owner's negligence are not covered.

BOAT INSURANCE

Find the perfect agent to shop multiple insurance companies on your behalf, saving you time and money.

Boat owners can experience a lot of joy and excitement brought by their watercraft, but they also have to anticipate potentially costly disasters ahead of time. Aside from accidents on the water, your boat is also vulnerable to theft, vandalism, flood damage, and more. That's what makes having boat insurance so critical.

An independent insurance agent can help protect your vessel with the right boat insurance long before you ever need to file a claim. But first, here's some boat insurance 101.

What Is Boat Insurance?

Boat insurance is designed to cover boat owners and their watercraft in case of many different disasters, including accidents, fire, and more. These policies are made to protect boats that have motors, like yachts, pontoon boats, etc., but they don't cover kayaks or canoes. Boat insurance is important because homeowners insurance doesn't provide enough coverage on its own for most watercraft.

Do You Have to Have Insurance on a Boat?

Only two states actually require boat insurance coverage , but there are a few situations where you may need it. First, if you dock your boat at a marina, they may require some form of coverage in order to protect their business. Second, if you financed your boat, nearly every lender will require coverage to protect their investment.

Further, there are certain types of boats that are more important to insure than others due to their value, risk level, and more. Here's a handy guide to whether you need boat insurance for your vessel.

| Boats that need insurance: | Boats that don't need insurance: |

|---|---|

| Boats that have 25 horsepower or greater | Boats with less than 25 horsepower |

| Yachts | Small engine boats |

| Large sailboats | Small sailboats |

| WaveRunners | Canoes |

| Jet boats | Inexpensive boats |

Most often, boat insurance is purchased for:

- Utility boats

- Fishing boats

- Pontoon boats

Despite all the fun to be had with a boat, accidents and disasters can happen. The easiest way to protect yourself and others, and get you back on the lake after a situation, is with the right boat insurance.

Best Boat Insurance Companies

While many carriers offer boat insurance, it's helpful to know some of the top names in the industry before you start shopping. Here are a few of our highest-recommended boat insurance companies.

| Top Boat Insurance Companies | Star Rating |

|---|---|

An independent insurance agent can help you get the right boat insurance policy for you from one of these top-rated carriers, or another that best meets your needs.

Do I Need Boat Insurance?

The only two states that require boat insurance by law are Utah and Arkansas. Boat owners in these states must have coverage for personal watercraft or for powerboats with 50 horsepower or greater. Otherwise, if you live elsewhere and your boat is designated for personal use, you're not technically required to have insurance for it.

However, if you lease or otherwise finance your boat, you're likely to be required by your lender to carry boat insurance, and often you'll need both collision and comprehensive coverage. When docking your boat, you're often also required by the marina to have liability coverage. However, with boating accidents being so common, it's important to at least consider getting boat insurance for yourself.

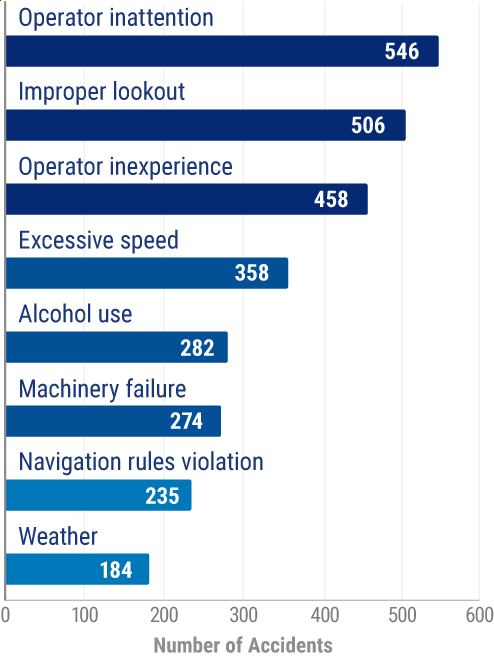

Most Common Types of Boating Accidents

Notice that the top five causes of boating accidents are due to human error, such as inattention, improper lookout, alcohol use, and inexperience. Since you can't often blame the boat for an accident or other disaster, it's even more critical to ensure that your vessel is covered with the right insurance.

How Much Is Boat Insurance?

The average annual cost of boat insurance ranges from $200 to $500 depending on the type of boat you have and other factors. It also depends on which types of coverage you need, and how much coverage you need. For folks who only purchase liability coverage, you might pay less than $100 annually.

Often, you can expect the annual cost of your boat insurance to be about 1.5% of the value of your boat. For example:

- $20,000 boats cost about $300 annually to insure

- $50,000 boats cost about $750 annually to insure

- $100,000 boats cost about $1,500 annually to insure

- $500,000 boats cost about $7,500 annually to insure

- $2 million boats, like yachts, cost about $30,000 annually to insure

- If you are looking for boat insurance for older boats , costs will vary significantly

The cost of your boat insurance might not be this simple to figure out, though. For more help calculating the cost of your premiums, use our boat insurance calculator or reach out to an independent insurance agent for a quote.

What Factors Influence Boat Insurance Costs?

Like any form of coverage, boat insurance costs depend on several factors, including:

The make, model, and value of your boat

Your boat's make, model, and value influence the cost of boat insurance because the more expensive your boat is to replace or repair, the more expensive your coverage must be. If your boat is valued at less than $20,000, you will pay approximately the average cost in your state. If your boat is valued above $500,000, you might pay up to 2,250% of the average cost in your state.

Your boat's length

Boat insurance costs also depend on the length of your boat. Be prepared to pay about 66% more for your coverage if your boat is 100 feet or longer, but if your boat is less than 20 feet, you may pay 12% less than average rates in your state.

Your boating records

If you've had six or more accidents or violations within the past five years, you can expect a 90% increase in your boat insurance premiums. However, if you've had no incidents during this time, you can expect a 40% decrease in your boat insurance premiums.

Your location

Boat insurance premiums vary considerably by the state you live in. Many factors can influence insurance costs by location, including crime rates, property values, and more.

How you use your boat

Depending on the risk level of the activities you perform with or on your boat, your premiums may be higher or lower. Using a boat for towing can be riskier than using it just for fishing, so boats used for fishing would be likely to have lower boat insurance premiums.

How often you use your boat

Similar to auto insurance, how often you use your boat can also influence your boat insurance rates, because the more you use it, the more likely an accident or other disaster is to occur. For boats that only get taken out on occasion, premiums for boat insurance can be much lower than those that get used daily on the water.

An independent insurance agent can provide you with quotes for boat insurance from several carriers near you.

What Discounts on Boat Insurance Exist?

Many insurance companies offer several discounts on boat insurance to help lower the cost of your premiums. Here are just a few common boat insurance discounts:

- Boater safety course discount: You might qualify for a discount on boat insurance if you complete a state-approved boater safety course.

- Bundling discount: Many insurance companies offer discounts if you bundle your boat insurance with another policy through them, such as auto insurance or home insurance.

- Paid-in-full discount: Many insurance companies lower your overall premium if you pay for your entire year's worth of coverage up-front.

- Homeowners discount: Some insurance companies even offer discounts on your boat insurance just for being a homeowner, even if your coverage is not through the same carrier.

- Clean boating history discount: You're likely to be rewarded with a boat insurance discount by many carriers if you've maintained a clean, accident and violation-free boating record.

Your independent insurance agent is a great ally in helping you find any discounts you may qualify for on boat insurance, no matter which carrier you go through.

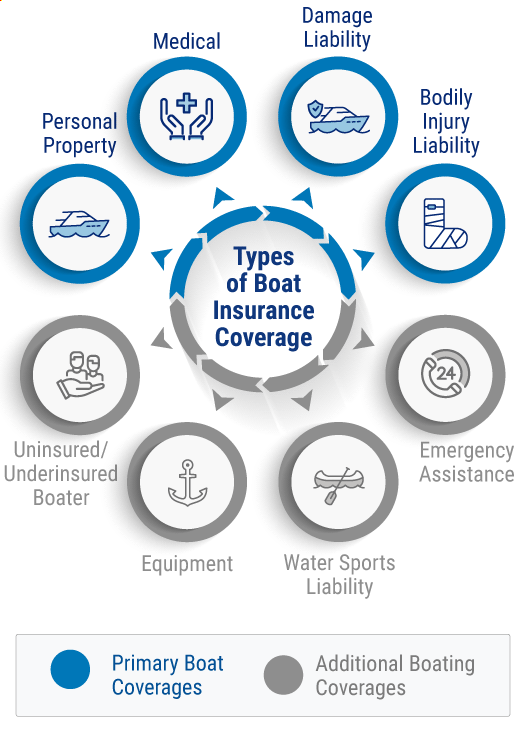

What Does Boat Insurance Cover?

Boat insurance provides a lot of important protection, not only for your boat, but also for you, your passengers, and everyone else on the water or at the marina. Boat insurance typically includes the following primary coverages:

- Personal property damage: Provides reimbursement for your boat, trailer, and engine if they're damaged by a covered peril like vandalism, fire, etc.

- Medical payments: Provides reimbursement for treatment of injuries to you and your passengers who get hurt by your boat or while on your boat.

- Property damage liability: Provides reimbursement of property damage lawsuit costs from third parties due to your boat.

- Bodily injury liability: Provides reimbursement for injuries to anyone who gets physically harmed by your boat.

The following coverages are commonly added to standard boat insurance:

- Uninsured/underinsured boaters: Covers injury expenses if the other boater is responsible but doesn’t have any, or enough, insurance to cover your expenses.

- Fishing equipment: Sometimes included, you'll be reimbursed up to a certain limit, like $1,000.

- Water sports liability: Some policies exclude water sports from your liability coverage and some don't, but this coverage is important if you'll be doing stunts, etc.

- Emergency assistance on the water: Also known as boat towing insurance, coverage provides water towing and other assistance services through a maritime dispatch center.

- Roadside assistance for your boat and trailer: This coverage guarantees that the towing company will take your vehicle, boat, and trailer to the nearest facility if you get stranded on the road.

If you have questions or concerns based on your plans on the water, it's best to talk to your independent insurance agent. They can help you find and increase coverage so that it works best for you.

Important Additional Coverages for Boats

Beyond the common coverages, it's always recommended to consider additional coverages that can help tailor the policy to your unique risks. Here are several optional boat insurance coverages worth considering:

- Collision: Provides coverage for collisions between your watercraft and other vessels or objects. You're also covered if your boat capsizes on the water.

- Comprehensive: Covers other disasters beyond collision like theft, vandalism, storm damage, and more.

- Hurricane hauling services: Covers the cost of moving your watercraft out of the county where it's docked in case of emergency.

- Personal property coverage: Personal property is usually covered under your homeowners policy, even when the boat isn't at your house. However, your deductible is often higher, so you can add personal property coverage on your boat policy to avoid a homeowners claim.

- Wreckage and fuel removal: Reimburses cost to recover or destroy wreckage and fuel if you get in an accident.

- Replacement cost or agreed value: Newer and more expensive boats can be insured for agreed value, which means you'll recover the full amount you paid for it, without depreciation.

- Pet coverage: If you boat with a pet on board, this provides up to $1,000 towards veterinarian fees if they're injured on the boat.

An independent insurance agent can recommend the additional boat insurance coverages that are a good match for you.

What Is Boat Rental Insurance Coverage?

Boat rental insurance is often required by boat rental companies to protect against lawsuits that may arise when you operate a rented vessel. If a third party sues you for claims of bodily injury or property damage when you're operating a rented boat and you don't have boat rental insurance, you'll have to pay out of pocket for your defense and settlement costs.

What Boat Insurance Will Pay For

Before settling on a boat insurance policy, it's important to understand just what it will reimburse you for and what it won't. Here's a breakdown for further clarification.

| Boat insurance pays for: | Boat insurance won't pay for: |

|---|---|

| Physical damage due to covered causes like theft, fire, etc. | Maintenance costs. |

| Physical damage to the boat and anchors or other equipment. | Machinery damage or defective equipment and boat components. |

| Medical expenses for those injured on or by your boat. | Medical expenses relating to shark bite injuries. |

| Property damage to others caused by your boat. | Property damage caused by insect infestations, mold, barnacles, etc. |

| Liability issues that arise when someone else drives your boat with permission. | Intentional harm caused to others with your boat. |

If you still have questions about what's covered or not covered by boat insurance, your independent insurance agent can help.

Finding Discounts and Savings on Boat Insurance

Fortunately, there are typically several discounts available for boat insurance. While options vary by insurance company, here are some common discounts:

- No claims history discount: If you've never filed a claim on your boat insurance, your carrier is likely to reward you with a discount over time.

- Diesel-powered boat discount: Some boat insurance companies offer discounts for watercraft with diesel-powered engines.

- Safety course discount: You might be eligible to receive a discount on your boat insurance if you complete a state-approved safety course.

- Bundling discount: Often you can save money on boat insurance if you bundle it with another type of coverage, such as home insurance, through the same carrier.

An independent insurance agent is your greatest ally when it comes to finding discounts on boat insurance.

Why Choose an Independent Insurance Agent?

Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut through the jargon and clarify the fine print so you know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best boat insurance, accessibility, and competitive pricing while working for you.

More Choices

Our independent insurance agents work for you, not the insurance companies. That means you always get the best coverage options to choose from.

Better Prices

When you have options from multiple companies, it's easier to find the best coverage at the right price, at no extra cost to you.

Local Services

There's an independent agent in every city who always understands the insurance coverage you need most based on local laws and needs that apply to you.

What our customers are saying

Work Done For Me

I looked at different individual companies, but it was so time-consuming to fill out each individual application and keep track of them all. Trusted Choice got back to me quickly and gave me an option that worked. I ended up with Travelers, which has a great price. The online process was pretty easy. Plus, they did the legwork for me. It was a great experience.

Multiple Options

I tried finding insurance myself but I wasn't coming up with very much. I contacted Trusted Choice and they looked at various options and presented it to me. Everything with the agent went very smoothly... He knew exactly what we wanted and searched accordingly. I was able to choose the one that I thought was best so it worked out for me. I'm happy that I did it that way.

I needed insurance for the home that I was buying and based on the pricing, I went with Trusted Choice. The process was all done online and I didn't really have to do too much. The website was also easy to use and navigate and it was not overly intimidating. Everybody that I've dealt with also seemed good and professional. It was a positive experience.

One-On-One Attention

Every year I search for insurance to make sure that I’m getting the best bang for my dollar. I went with an independent agent because if I go through them, I get that one-on-one instead of being just a number.... The experience was great.

Really Helpful

TrustedChoice.com was real helpful when I needed to get insurance. The agent gave me the basics of what I'd be getting if I got insurance with them.

Multiple Agents

I needed a different independent agent to get insurance and I went with Trusted Choice. Their website was helpful in connecting me to two or three other agents that I was able to speak to. Their site did what I needed.

More Coverage

Trusted Choice's online process is super easy. They pulled most of the information and I ended up going with one of their recommendations. Aside from them, everybody else was too expensive. Plus, the Trusted Choice agent offered more coverage.

Great Match

Everybody at TrustedChoice.com was helpful and pleasant. They set us up with a great match and gave us our best option and price.

Best Coverage and Rates

I did a lot of searching for insurance and I went with a Trusted Choice agent because they provided the best rates and coverage. I haven't had a claim but I know I'm covered and that's good news. I would recommend Trusted Choice.

888-462-7571

InsureTheBoat.com

Our Experience is the Difference

The premier national marine insurance agency, we are specialists in the boat insurance industry. whether your coverage is for personal watercraft or a charter boat business, we cast a wide net of options to best suit your insurance needs..

For over 30 years, we’ve provided insurance for boats, yachts, charter boats and mega yachts throughout the United States. Be it a 11ft Seadoo PWC, 45ft Sports fisherman or a 330 Custom Mega Yacht, let our 30+ years in marine insurance work for you. Experience at the Helm matters. Experience in vessel insurance matters. Let our Experience work for you!

How Experience Makes Us Better

- We are marine insurance specialists that live, breathe, and cruise boats just like you do.

- We work for you the client, and negotiate the best rates possible on your vessel.

- You get an experienced Marine Agent with direct contact via phone or email, you won’t be stuck on hold like those other insurance companies!

- When you Request A Free Quote , we market you to all the leading companies writing marine insurance, you do not just get one quote with one company, but the 3 best quotes for your unique risk.

- We are always adding new insurance companies to complement market needs.

- Why call 4 different agents when we have all the leading boat insurers?

When you have 5 minutes, Give Us A Try and see how we stack up against your current policy.

Facebook Posts

No more posts

- Search Search Please fill out this field.

- Personal Finance

Yacht Insurance: What It Means, How It Works

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

- Property Insurance: Definition and How Coverage Works

- The Importance of Property Insurance

- Personal Liability Insurance

- Scheduled Personal Property

- Non-Scheduled Personal Property

- Floater Insurance

- Unscheduled Property Floater

- Wear-and-Tear Exclusion

- Jewelry Floater

- Designer Clothes

- Consignments

- Guide to Landlord Insurance

- Best Landlord Insurance

- Do You Need Mobile Home Insurance?

- Modular vs. Manufactured Home Insurance

- How to Insure Your Tiny Home

- Yachts CURRENT ARTICLE

- Umbrella Insurance

- How Umbrella Policies Work

What Is Yacht Insurance?

Yacht insurance is an insurance policy that provides indemnity liability coverage for a sailing vessel. It includes liability coverage for bodily injury or damage to the property of others and damage to personal property on the vessel. Depending on the insurance provider, this insurance could also include gas delivery, towing, and assistance if your yacht gets stranded.

Key Takeaways

- Yacht insurance provides indemnity liability coverage for a sailing vessel.

- It has two principal parts: hull insurance and protection and indemnity (P&I) insurance.

- While there is no legal agreed upon length that separates a yacht from a pleasure boat, generally it is considered to be somewhere between 27 and 30 feet.

Understanding Yacht Insurance

Some companies specialize in providing coverage for antique and classic boats. You can choose between an actual cash value or agreed value policy. The former is cheaper but factors in depreciation and market value, so your payout will be less. Some policies include discounts based on your boating education, safety features, and whether you have a hybrid or electric boat. Some companies also offer a package deal that decreases the rate on a yacht insurance policy if you purchase additional policies, such as for your home or car.

Boats are defined as vessels under 197 feet long, while ships are 197 feet long or longer. There is no agreed upon length for a yacht , but they are generally considered to be at least 30 feet long. A vessel under 27 feet is considered a pleasure boat.

Although there isn't a standard definition of what the size of a yacht is, we can see that there is a general agreement within a range. With that being said, this general range falls within class 2 and class 3 of the Federal boat classification system.

For its own purposes, the National Boat Owners Association marks the dividing line at 27 feet. Most yacht coverage is broader and more specialized than pleasure boat coverage, because larger vessels travel farther and are exposed to greater risks.

Yacht insurance is broader and more specialized than pleasure boat coverage, due to the fact that a yacht can sail farther and thus runs greater risks.

A yacht insurance deductible, the amount of money you must pay out of your own pocket before your insurance kicks in, is usually a percentage of the insured value. A 1% deductible, for example, means that a boat insured for $100,000 would have a $1,000 deductible. Most lenders allow a maximum deductible of 2% of the insured value.

Generally, yacht insurance coverage does not include wear and tear, gradual deterioration, marine life, marring, denting, scratching, animal damage, osmosis, blistering, electrolysis, manufacturer’s defects, defects in design, and ice and freezing.

Two Parts of Yacht Insurance

There are two principal sections of a yacht insurance policy.

Hull insurance